- Australian retail sales and building approvals beat expectation in May

- Markets see an RBA rate hike in August as a line-ball call

- AUD/USD pushes towards range highs

- USD/CNH threatens to break to fresh 2024 highs, creating possible headwinds for AUD

Cross currents converge for AUD/USD

Bargain hunting by consumers and signs of a bottoming in housing construction have bolstered the case for the Reserve Bank of Australia (RBA) to resume lifting interest rates after last week’s hot May inflation report, sending AUD/USD back towards of the top of its trading range. But whether it can break through may be determined by what happens with other Asian currency names, especially the Chinese yuan which continues to weaken against the US dollar.

Australian retail sales breeze past expectations

Adding to the case for the RBA to resume its tightening cycle for the first time since November after the uncomfortably strong inflation print last, Australian retail sales breezed past expectations in May, lifting 0.6% compared to forecasts for an increase of 0.2%.

The pop followed a gain of 0.1% in April and decline of 0.4% in March, leaving nominal turnover up 1.7% from a year earlier. Positive yet still weak.

Turnover rose across most non-food related industries, encouraged by deep discounting before the end of the financial year in Australia. Clothing, footwear and personal accessory retailing jumped 1.6% following two consecutive falls. Household goods retailing was similarly strong, lifting 1.1%.

Building approvals up again in May

Like retail spending, building approvals also bounced from a weak base in May, lifting 5.5% relative to expectations for an increase of 1.6%. Apartment approvals – which are often volatile – surged 16.3% while private sector housing approvals rose by a smaller 2.1%.

While still well below the levels seen over much of the past decade, total dwelling approvals have now increased every month in 2024, suggesting the pipeline for new residential construction may have bottomed.

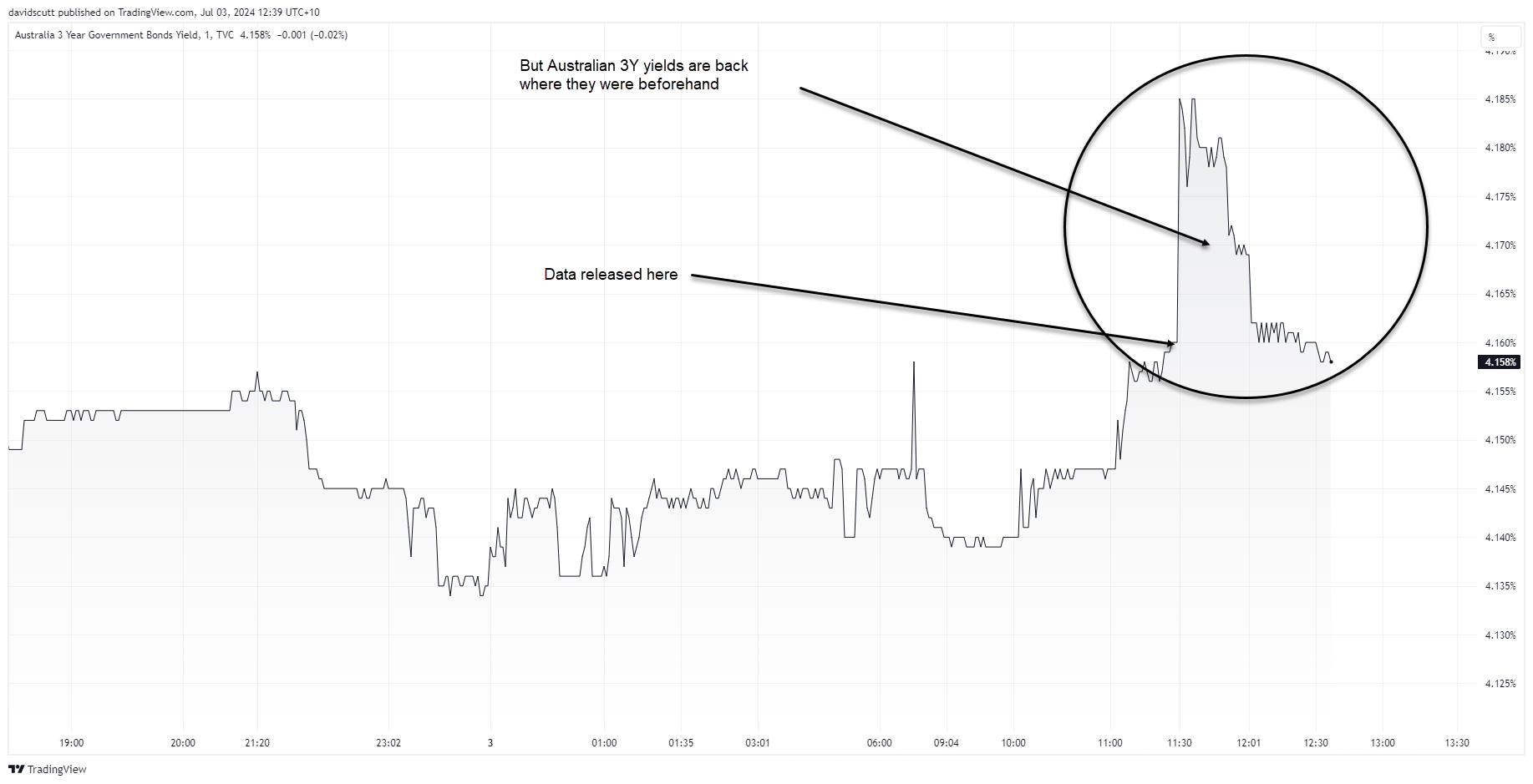

AUD/USD gains, Australian short-end rates reverse

The market reaction to the set of beats was much as you’d expect with AUD/USD and three-year Australian government bond yields pushing higher, reflecting a greater risk of the RBA having to restart its rate tightening cycle. However, while the Aussie has held its gains there has been a reversal in Australian rates markets, likely reflecting the view the strength in the retail sales report may be reversed in the following months.

That may be true, but money was still found to hit the shops which casts doubt over how hard-up Australian households are right now, especially with income tax cuts now flowing through to every worker. Markets continue to see the risk of a 25-point hike in August as a line-ball call with Australia’s June jobs report next week and Q2 CPI at the end of July the two key releases that could shift pricing definitively.

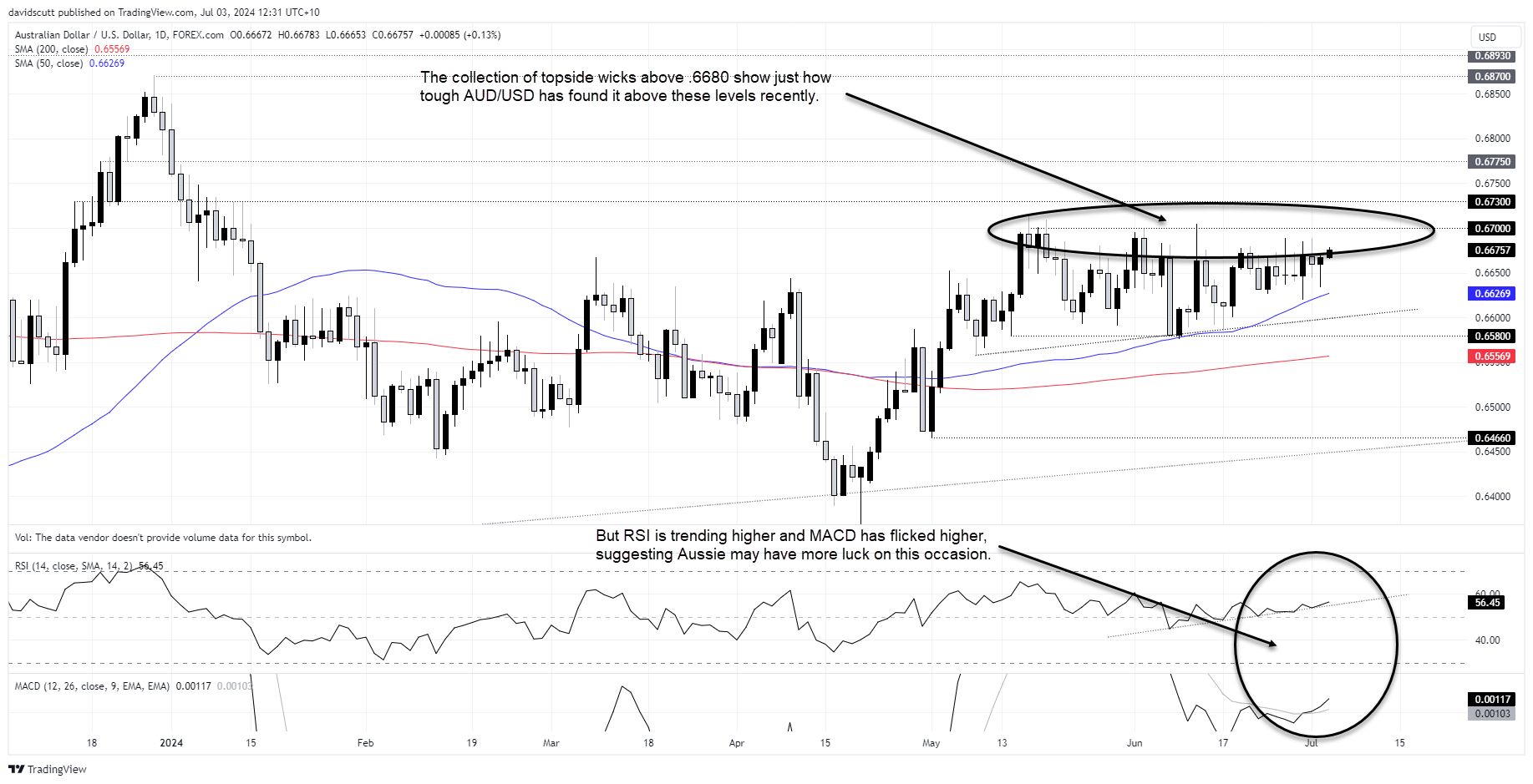

AUD/USD upside looking tough

Turning to the AUD/USD daily, you can see it’s pushed back towards the top of its sideways range on the back of the data. However, the litany of topside wicks above .6680 shows just how difficult AUD/USD has found it to advance beyond these levels since May. However, with RSI trending higher and MACD delivering a bullish signal, perhaps the tide is turning?

Personally, I’d want to see a break and close above .6700 before contemplating longs given the recent track record. Should it give way, .6730, .6775 and December 2023 peak of .6870 are the topside levels to watch.

On the downside, the 50-day moving average and support layered between .6600 down to .6580 have made for good buying recently.

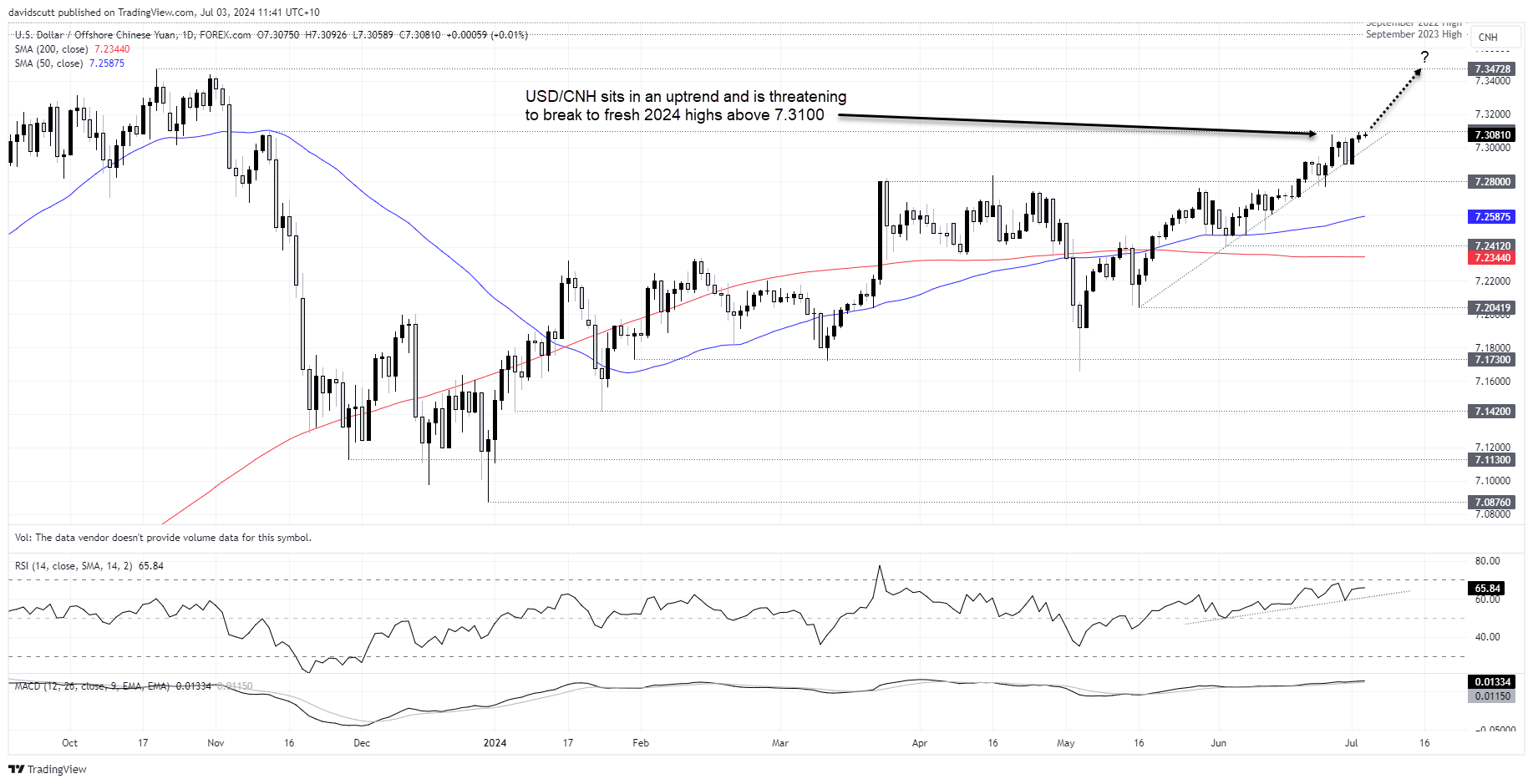

Especially if Chinese yuan continues to crater

When it comes to whether not only the AUD/USD will be able to push higher on a sustainable basis, don’t discount the influence of the Chinese yuan in the short to medium-term. With USD/CNH threatening to break to fresh 2024 highs on Wednesday, it points to continued headwinds for AUD/USD upside, if and when it occurs.

7.3100 is the level to keep an eye on with a clean break there pointing to the risk of the bullish trend extending to 7.34728.

-- Written by David Scutt

Follow David on Twitter @scutty