- China announced more stimulus measures, riskier assets are rallying, Asian currencies are bid and New Zealand’s inflation report showed sticky domestic price pressures

- The Australian dollar would normally rally in this type of backdrop but didn’t on Wednesday

- EUR and USD are looking firm against the AUD

The Australian dollar was given every excuse to rally on Wednesday and didn’t, finishing the session lower than where it started. China announced a swathe of easing measures, following through on speculation that had been bubbling away for months. Other Asian currencies strengthened, led by hawkish BOJ bets bolstering the Japanese yen, while New Zealand reported continued heat in domestic inflationary pressures in the December quarter, an outcome that may have implications for Australia when its inflation report card is released on Wednesday next week.

When you consider we’re likely to be bombarded by headline after headline telling us consumer price inflation in the United States has returned to the Federal Reserve’s 2% target on a three and six-month annualised basis, unless we see a big upside surprise in either the quarterly or monthly prints, the Aussie dollar was given an open invitation for upside and failed to take it.

Telling. While a late reversal in the Japanese yen and Chinese yuan likely contributed to the Aussie’s spluttering performance, reacting to a bounce in US 2-year Treasury note yields which weighed on US equities into the close, it was a disappointing performance given the tailwinds received. Today, the performance of Chinese equities and USD/CNH may be influential on how the AUD fares.

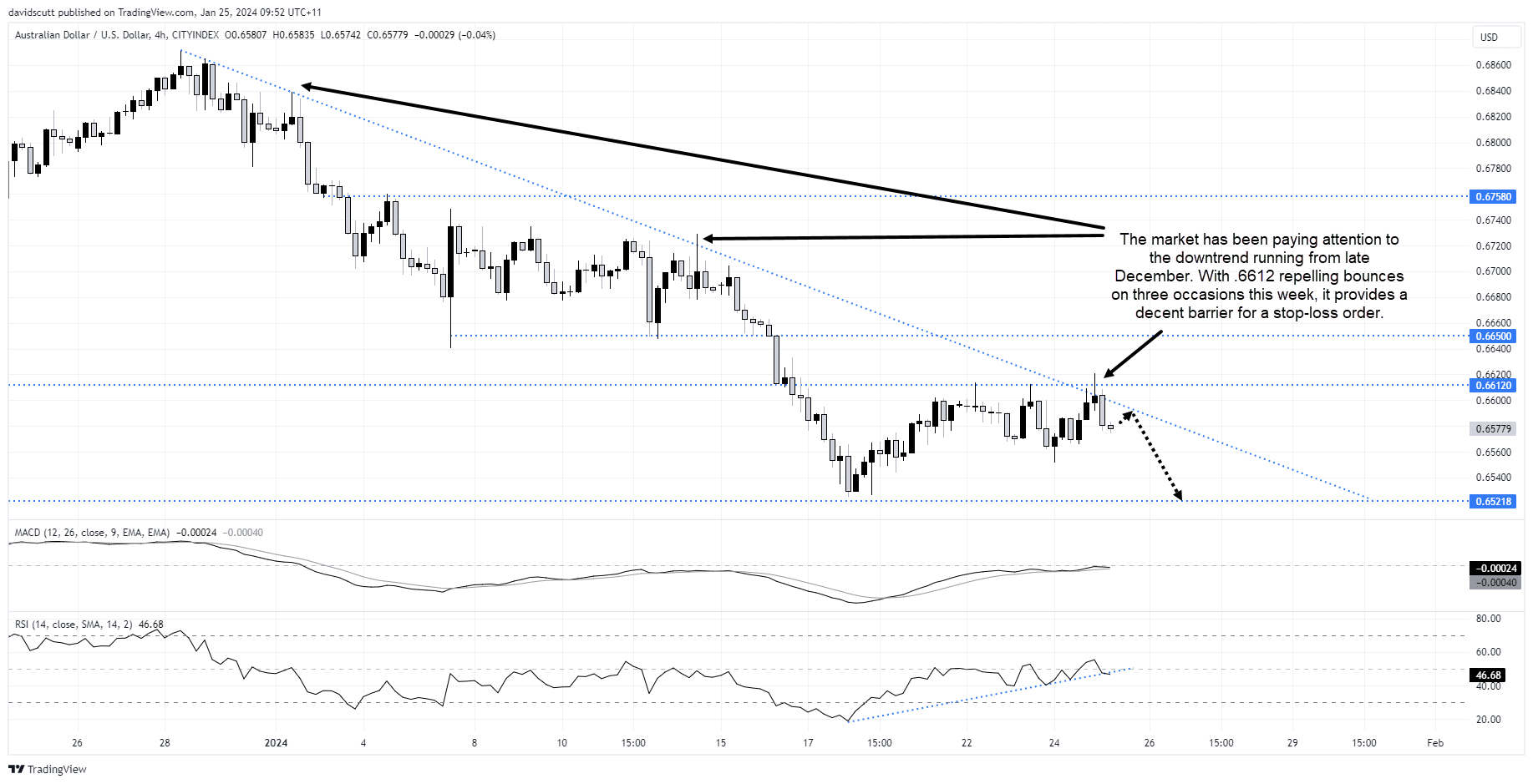

AUD/USD rejected again above .6600

You can see technical factors may have contributed to the Aussie’s performance, running into sellers above .6612 for the third time this week. The latest rejection also occurred at the intersection of downtrend resistance running from the highs struck in late December. While MACD and RSI suggest upside momentum remains intact, both appear at risk of rolling over. Price may well follow suit if the market can’t get excited about the positives the Aussie has received. As such, risks may be skewed to the downside near-term.

For those considering a short, should we see another push towards and failure at downtrend resistance located just below .6600, it will provide an opportunity to initiate a trade targeting a move back towards support at .6520. A stop above .6612 would offer protection against reversal.

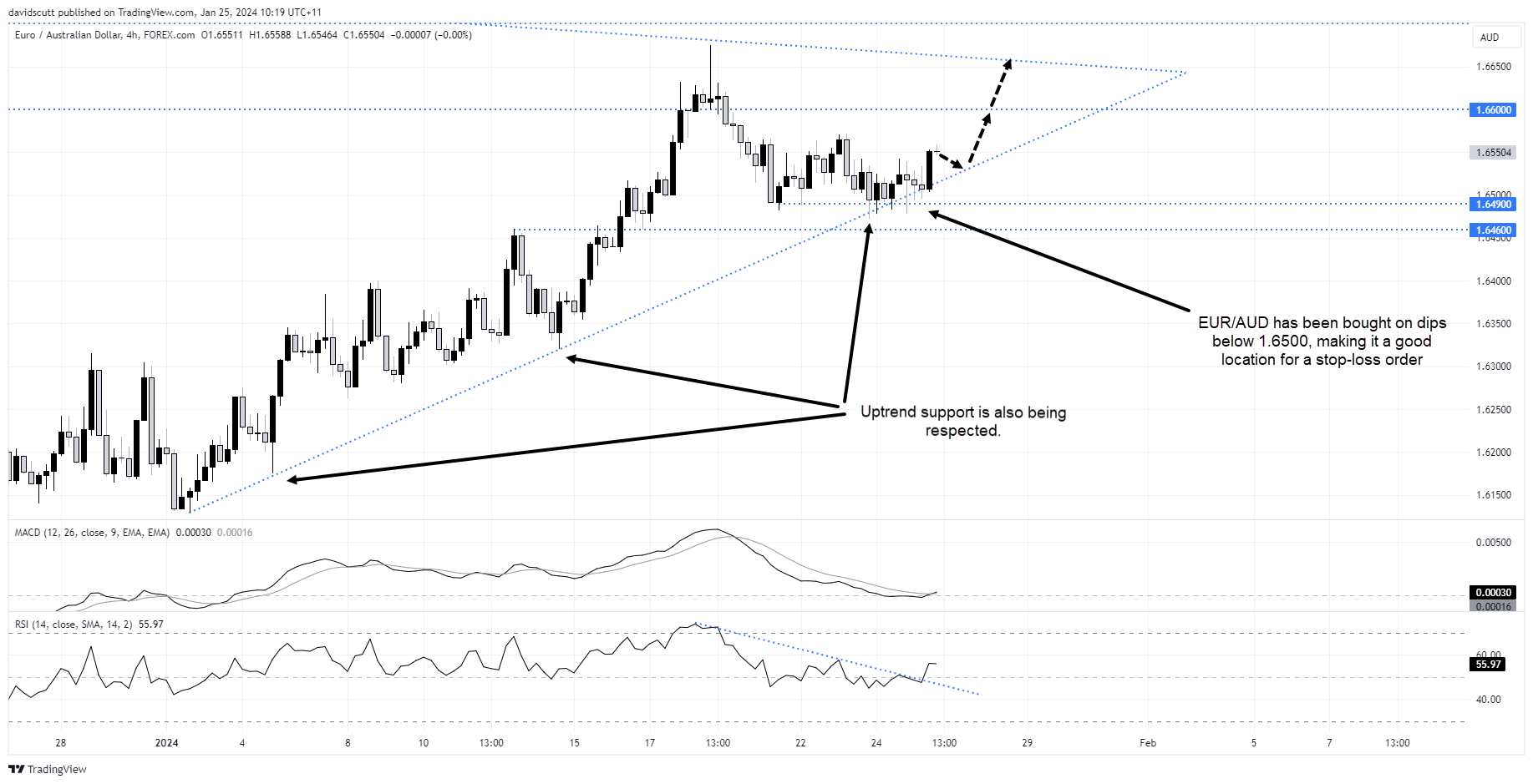

EUR/AUD bounces from support cluster

Similar to the price action against the USD, AUD has struggled against the EUR recently with EUR/AUD rebounding on Thursday after numerous failed attempts below 1.6500, the location of the 200-day moving average on the daily charts. Zooming in marginally, EUR/AUD continues to respect uptrend support dating back to the start of the year, suggesting the path of least resistance may be higher in the near-term. With MACD crossing over from below and RSI breaking it’s downtrend, it bolsters the case for upside.

A pullback and failure to break the uptrend will provide the opportunity to initiate long trades targeting a retest of long-running downtrend resistance currently located around 1.6665. In between, there may be some resistance located at 1.6600. A stop below 1.6490 would offer protection against a reversal.

On the macro front, the ECB will announce its first interest rate decision of 2024 later Thursday, followed by a press conference with President Christine Lagarde. While this carries significant event risk, having heard from so many ECB members last week, and with little fresh information received since then, it’s questionable just how much it will influence markets on this occasion.

-- Written by David Scutt

Follow David on Twitter @scutty