Two key events for currency markets this week will revolve around recent central bank decisions from the Reserve Bank of Australia (RBA) and US Federal Reserve. Minutes from the RBA’s August 1st meeting will be released on Tuesday in Australia, while minutes from the late-July FOMC meeting will be released on Wednesday. Both of these central bank decisions were initially seen as neutral-to-dovish, prompting subsequent drops in their corresponding currencies. This week’s release of comprehensive minutes from those meetings is likely to have a further impact on both the Australian dollar and US dollar.

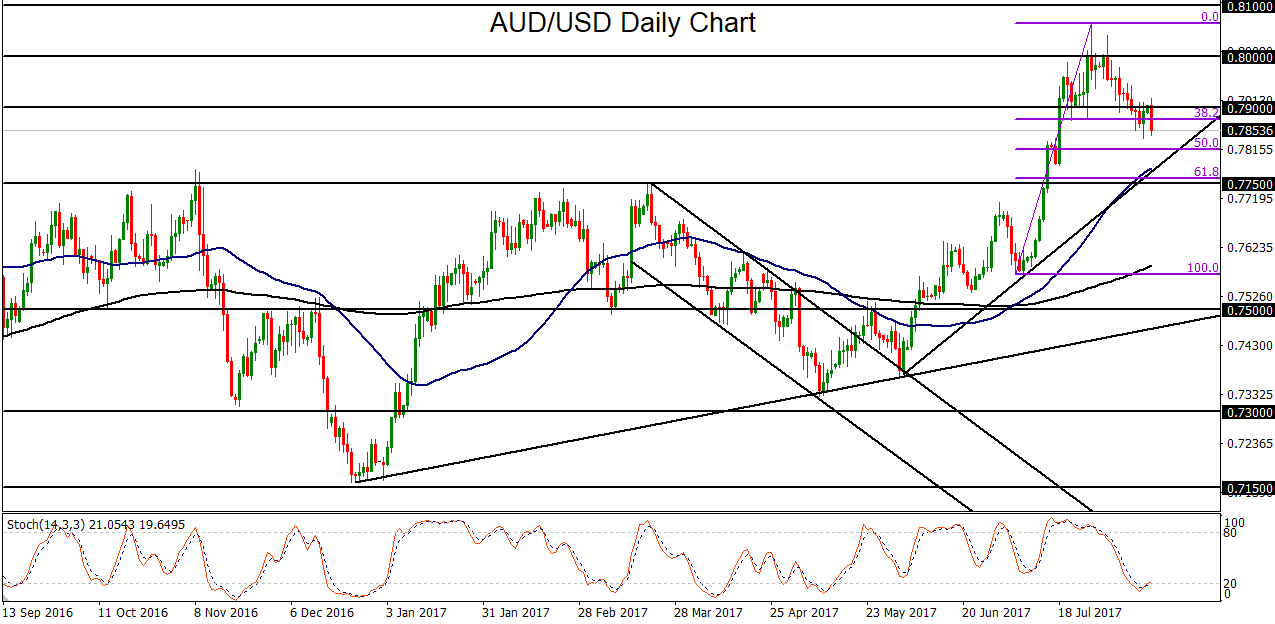

In the run-up to the releases, AUD/USD has been entrenched for the past two weeks in a sharp pullback from the late-July high above the key 0.8000 psychological resistance level. This pullback, which followed a sharp uptrend, began shortly after the RBA expressed concerns over low wage inflation and the strength of the Australian dollar, while the US dollar simultaneously started to find some relief from previously prolonged pressure.

From a technical perspective, the AUD/USD pullback has prompted a tentative breakdown below the 0.7900 level as well as a key 38.2% Fibonacci retracement level. This breakdown suggests a potentially deeper pullback or possible reversal of the sharp uptrend that has been in place for the past three months. In the event of such continued bearish momentum, the next major downside target resides around the key 0.7750 support area, which is a major previous resistance level and just below an important 61.8% Fibonacci retracement level.