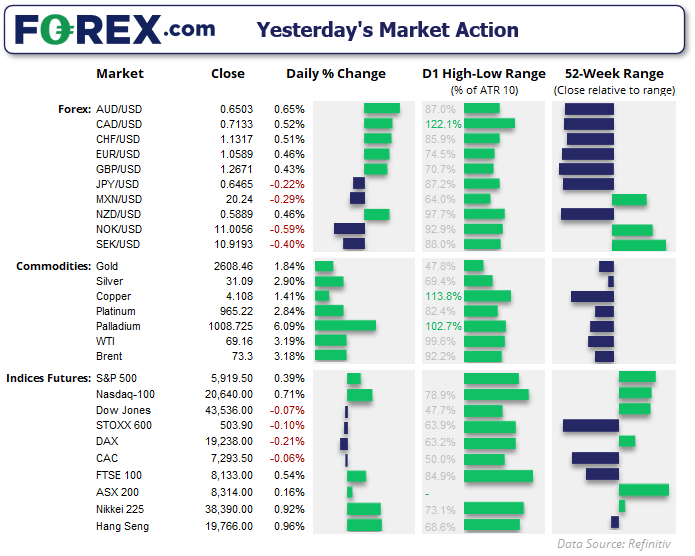

The USD handed back some more of last week's gains on Monday to mark a second day lower from its 1-year peak. This week presents a light economic calendar for the US, which makes Trump's cabinet picks a likely driver for USD sentiment alongside Nvidia's earnings on Wednesday.

AUD/USD and EUR/USD were the strongest FX majors as mean reversion against the dollar kicked in. The Australian dollar also benefited from a bounce in key commodity prices. Gold attracted safe-haven flows after President Biden announced a long-range missile for Ukraine to reach deeper into Russian territory. News that a Norwegian oilfield had been halted also sent WTI crude oil prices up over 3.3%.

Despite broad USD weakness, it was the Japanese yen which was the weakest major after BOJ Governor Ueda was vague regarding the timing of any interest rate hike. While USD/JPY closed the day 0.25% higher, it remains overshadowed by Friday’s bearish engulfing day of -1.25% when Japan’s Finance Minister pushed back against currency speculators.

Events in focus (AEDT):

- 11:30 – RBA meeting minutes

- 19:45 – ECB Elderson speaks

- 21:00 – EU CPI

- 23:00 – NZ Milk auctions

- 00:30 – US building permits, housing starts

- 00:30 – CA CPI

- 03:30 – USGDPnow

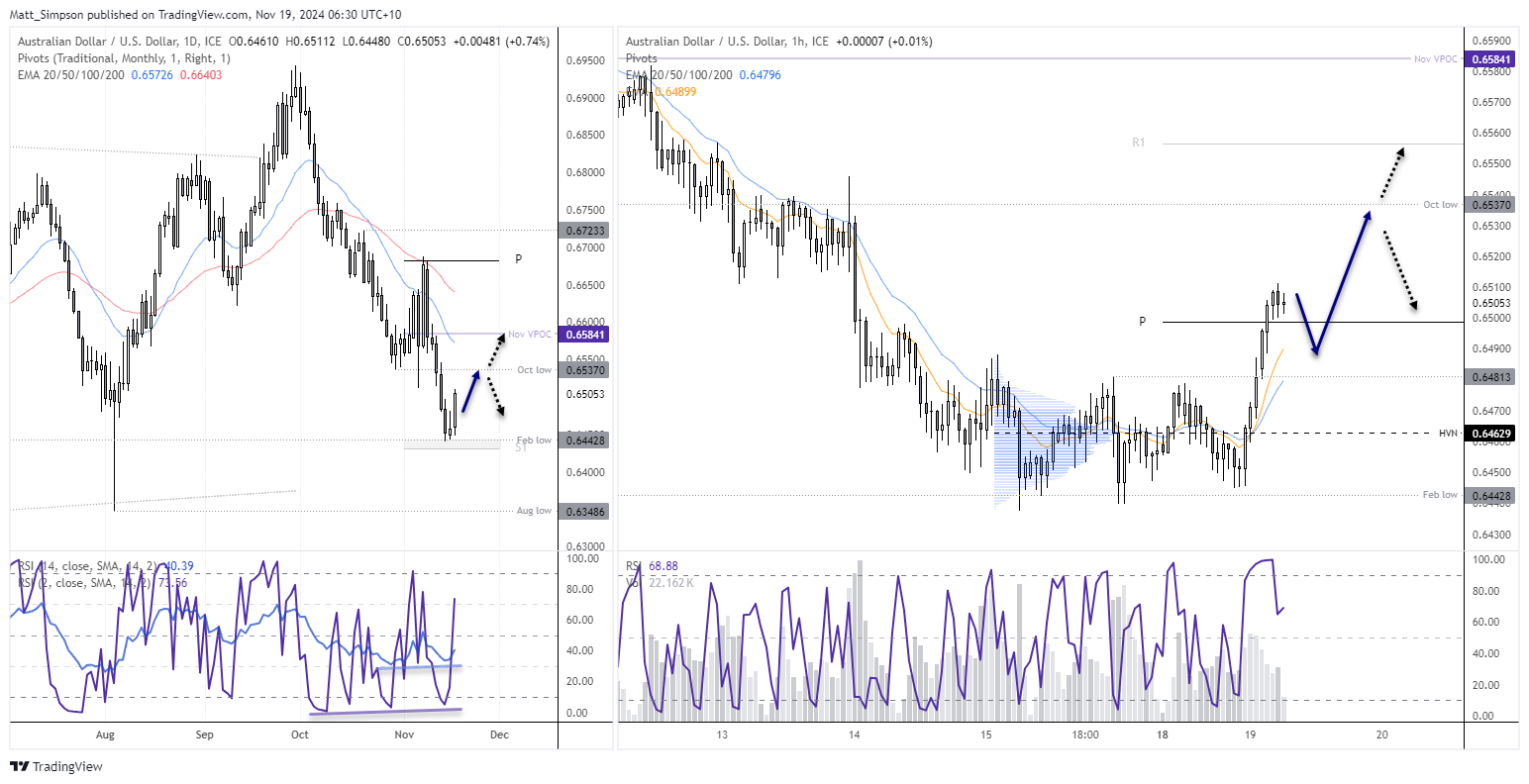

AUD/USD technical analysis:

AUD/USD completed a three-day bullish reversal pattern on Monday (dark cloud cover). That is also formed perfectly at the February low, just above the monthly S1 also adds weigh to the reversal. Moreover, bullish divergences formed on the RSI (2) and RSI (14).

Being bullish AUD/USD is likely not a popular idea. But that tends to be the case at turning points. Also note the strong bullish momentum on the 1-hour chart which suggests further upside potential over the near term. Bulls could seek dips within Monday’s range, such as the 0.6810 high or high-volume node (HVN) at 0.6429.

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge