- Risk assets have often performed well ahead of recent US CPI reports

- Another weak report is expected on Wednesday, potentially bolstering the case for the Fed to cut by 50 in September

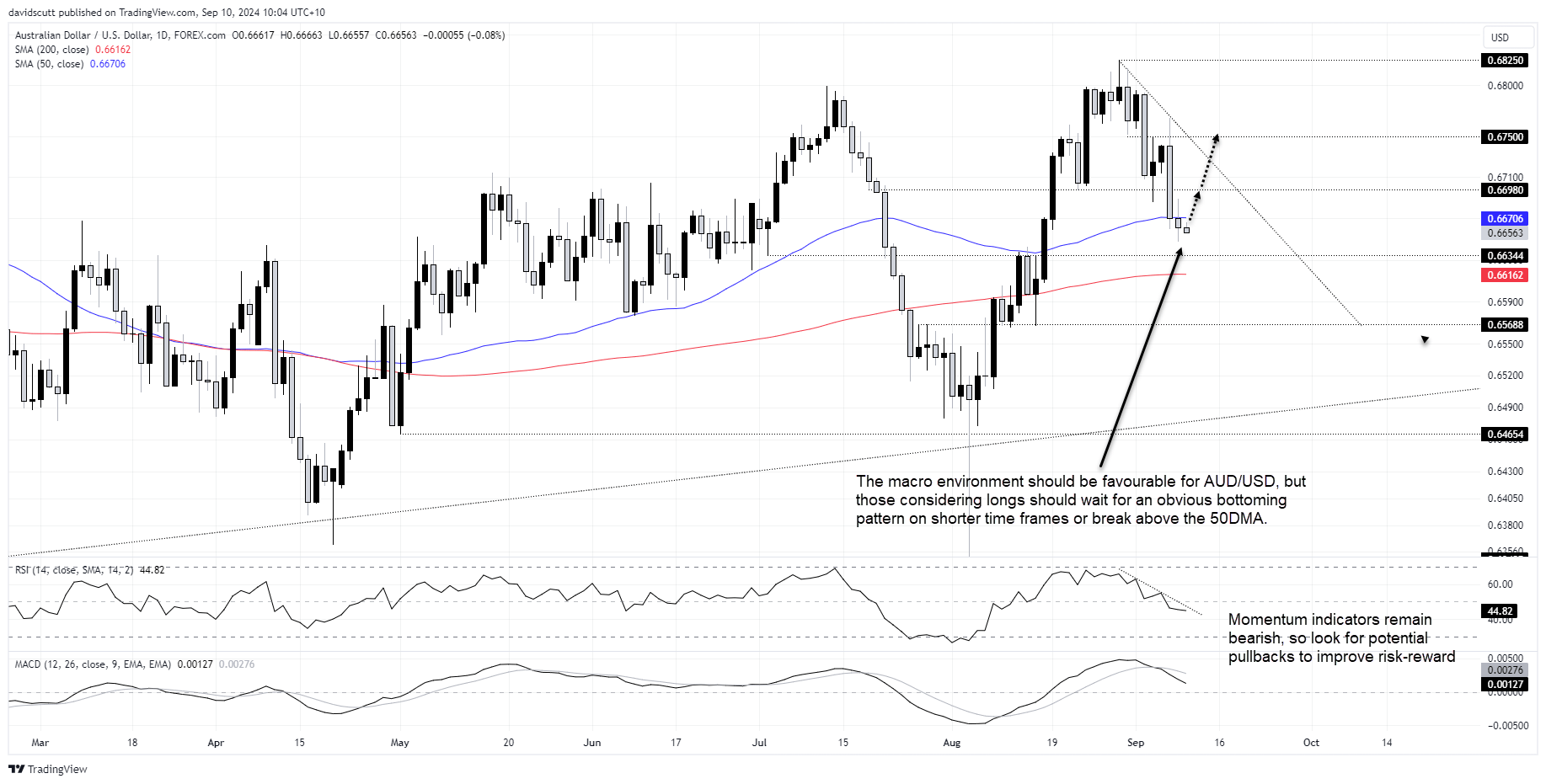

- AUD/USD struggled to push above the 50DMA on Monday after falling through it on Friday

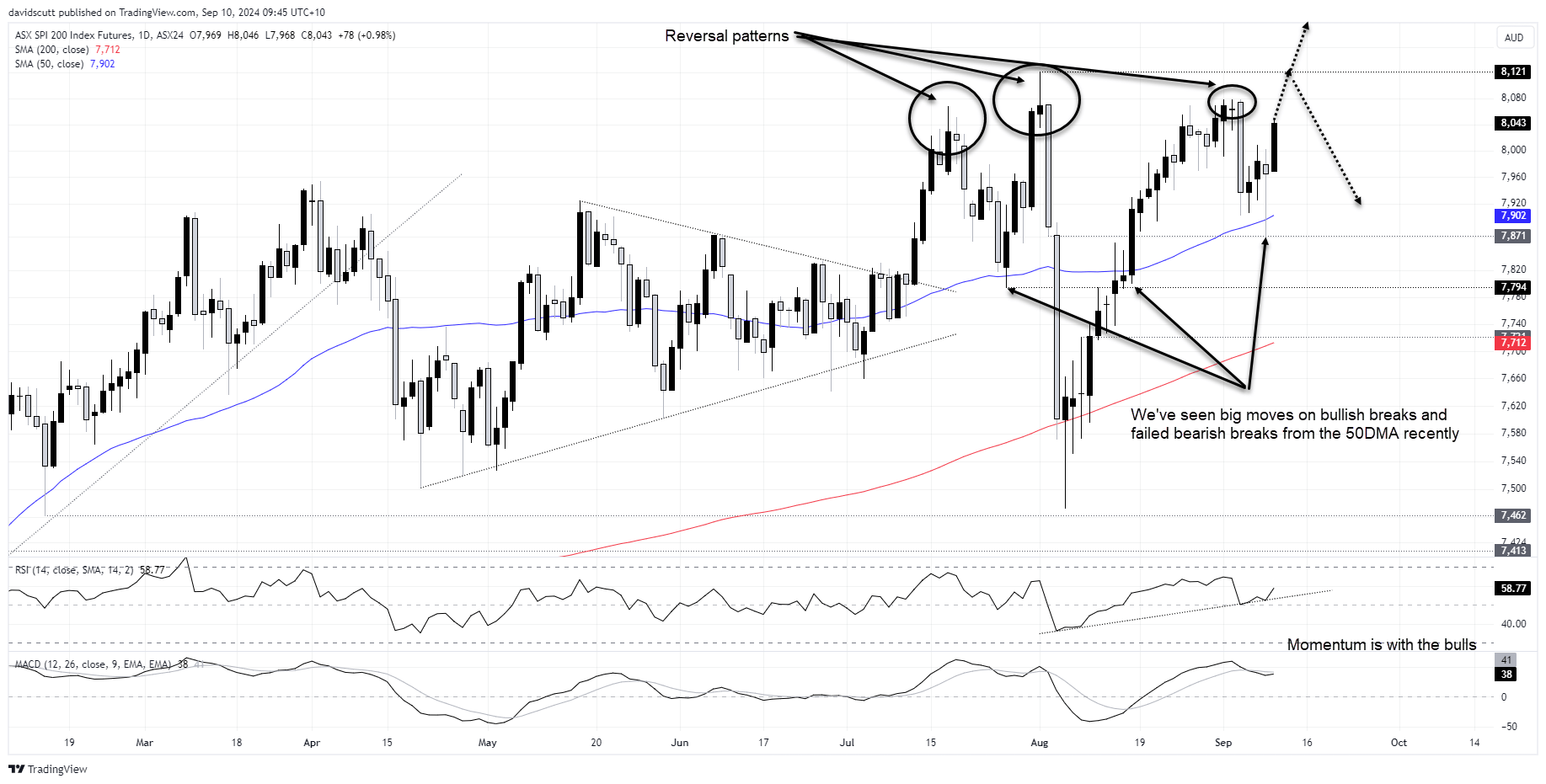

- Australian ASX 200 SPI futures are nearing territory littered with prior reversal patterns

Overview

Riskier asset classes have often performed well ahead of US consumer price inflation reports recently given the likelihood of further softening in housing categories. For AUD/USD and Australia’s ASX 200 SPI futures, such an environment should be advantageous for near-term gains. However, while the Aussie dollar may have room to rally, for Australian equities, that will take them back into territory where they’ve struggled to overcome in the past.

US CPI overrides today’s economic data

I don’t want to totally dismiss the importance of Australian consumer and business confidence figures released on Tuesday, nor China’s latest trade report, but those releases will pale in significance to Wednesday's US CPI report give the implications on how the Fed may proceed with interest rates.

So many markets have been closely aligned with shifts at the front of the US yield curve recently, and I doubt that will change given the difference between a 25 or 50 basis point rate cut from the Fed in September may come down to details in the inflation report.

With US Treasury auctions of three, 10 and 30-year debt scheduled later in the week, it could also heavily influence demand given inflation expectations are a big part of determining relative fair value.

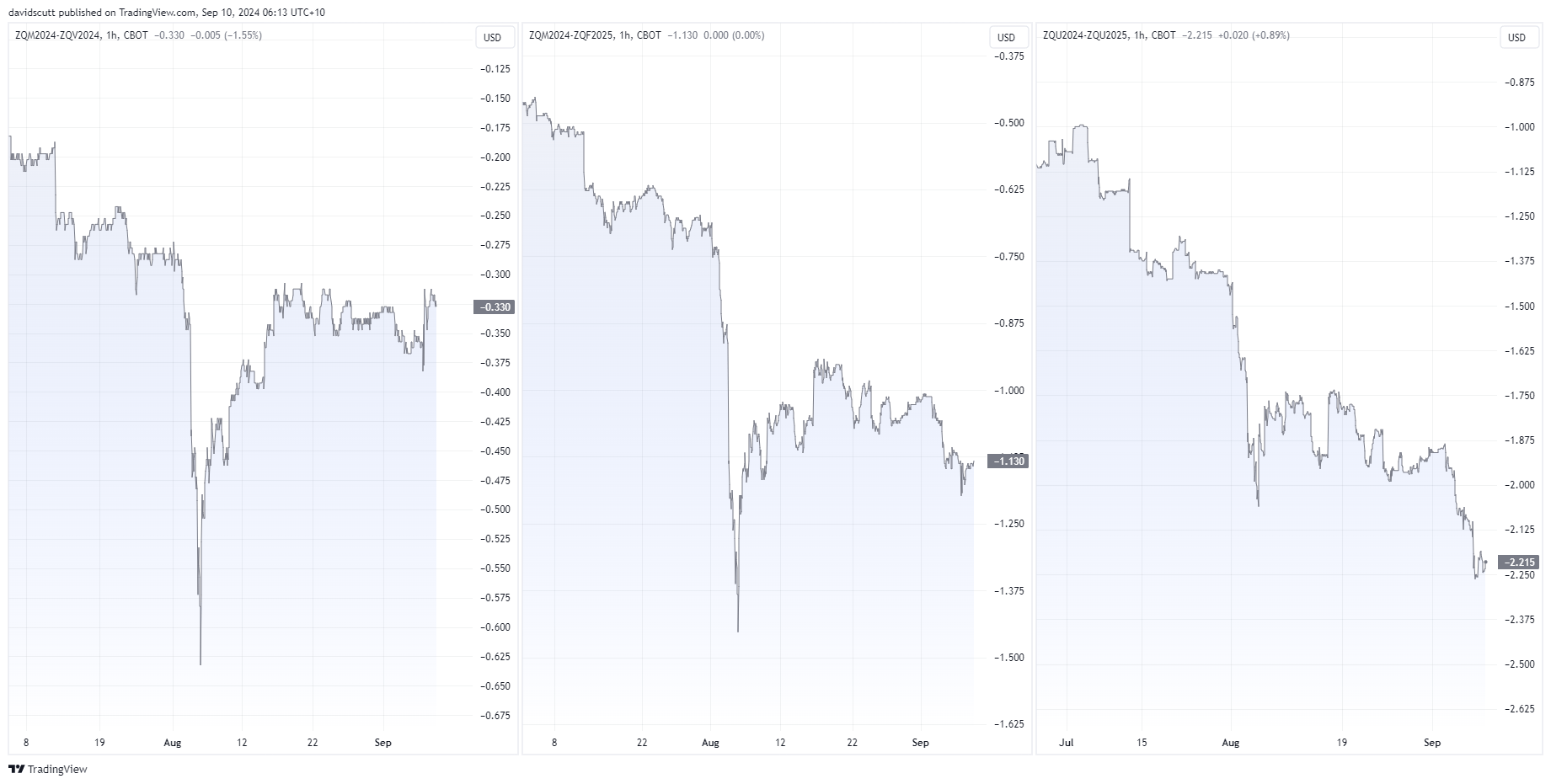

Fed rate cut pricing needs a weak CPI report to be sustained

Heading into the inflation report, Fed funds futures are pricing in around 32 basis points of cuts for the FOMC September meeting, implying a less than quarter chance of a 50 being delivered. Over the course of 2024, 114 basis points are priced with 221.5 expected over the next year. They’re big numbers, no doubt, but even easing of that magnitude would only get the funds rate back to levels where the Fed believes it will neither add to nor detract from inflationary pressures.

I’m no expert in slicing and dicing the CPI report, but what I know is another modest 0.2% increase in inflation ex-food and energy is expected. With housing components continuing to moderate, generating a disinflationary trend as the largest component in the inflation basket, it may take big increases elsewhere to create an upside surprise.

Should we see another 0.2% gain, the read-through to the Fed’s preferred underlying inflation gage, the core PCE deflator, would point to downside risks given housing is a smaller component in that measure.

In such a scenario, unless the data is so weak that it raises concerns about rapidly softening demand, riskier asset classes are likely to enjoy the prospect of a slightly softer US dollar and lower risk-free Treasury yields.

AUD/USD doing battle with the 50DMA

AUD/USD was unable to benefit from the bounce in commodity prices on Monday, hinting the move in those markets was just a countertrend rally following recent losses. The strength in the US dollar against the Japanese yen was another inhibiting factor, keeping the dollar firm despite the positive risk tone. However, with short-term market positioning now arguably less stretched, and with the focus on the US inflation report, it may provide a window for the Aussie to outperform.

While there’s no obvious bottoming pattern on the daily chart, those looking for a bounce in the near-term could consider buying dips towards .6656 with a stop below .6648 for protection. Possible targets include .6698 or the intersection of horizontal and downtrend resistance around .6750.

Right now, RSI (14) and MACD are generating negative signals on momentum, so don’t rush in unless you see an obvious signal to get bullish. For mine, if the price were to push through the 50-day moving average, it would improve the prospects of the trade considering how consistently respected it’s been in recent months.

ASX 200 SPI futures near key level

As for ASX 200 SPI futures, the bounce from the 50-day moving average was impressive on the back of decent volumes, sowing the seeds for the bullish candle that printed in overnight trade. With banks, materials and energy sectors outperforming on Wall Street, it bodes well for Australia’s three largest sectors by market cap.

However, while momentum indicators are generating bullish signals, futures have returned to levels littered with failed breaks and topping patterns. Personally, after the big move we’ve seen, I’m prepared to wait to see whether the price can take out the highs set earlier this year. The recent track record is not great, making the risk-reward for going long at these levels look anything but compelling. If we see a bullish break, great. But if we see another obvious topping pattern, be prepared to fade the bounce.

Support is located at the 50-day moving average, 7871 and 7794. On the topside, watch for selling around 8080 where the last three bullish moves have failed.

-- Written by David Scutt

Follow David on Twitter @scutty