Attempts to ram EUR/AUD and GBP/AUD into higher trading ranges failed last week, suggesting the Aussie dollar may be starting to rediscover its mojo against some major European crosses.

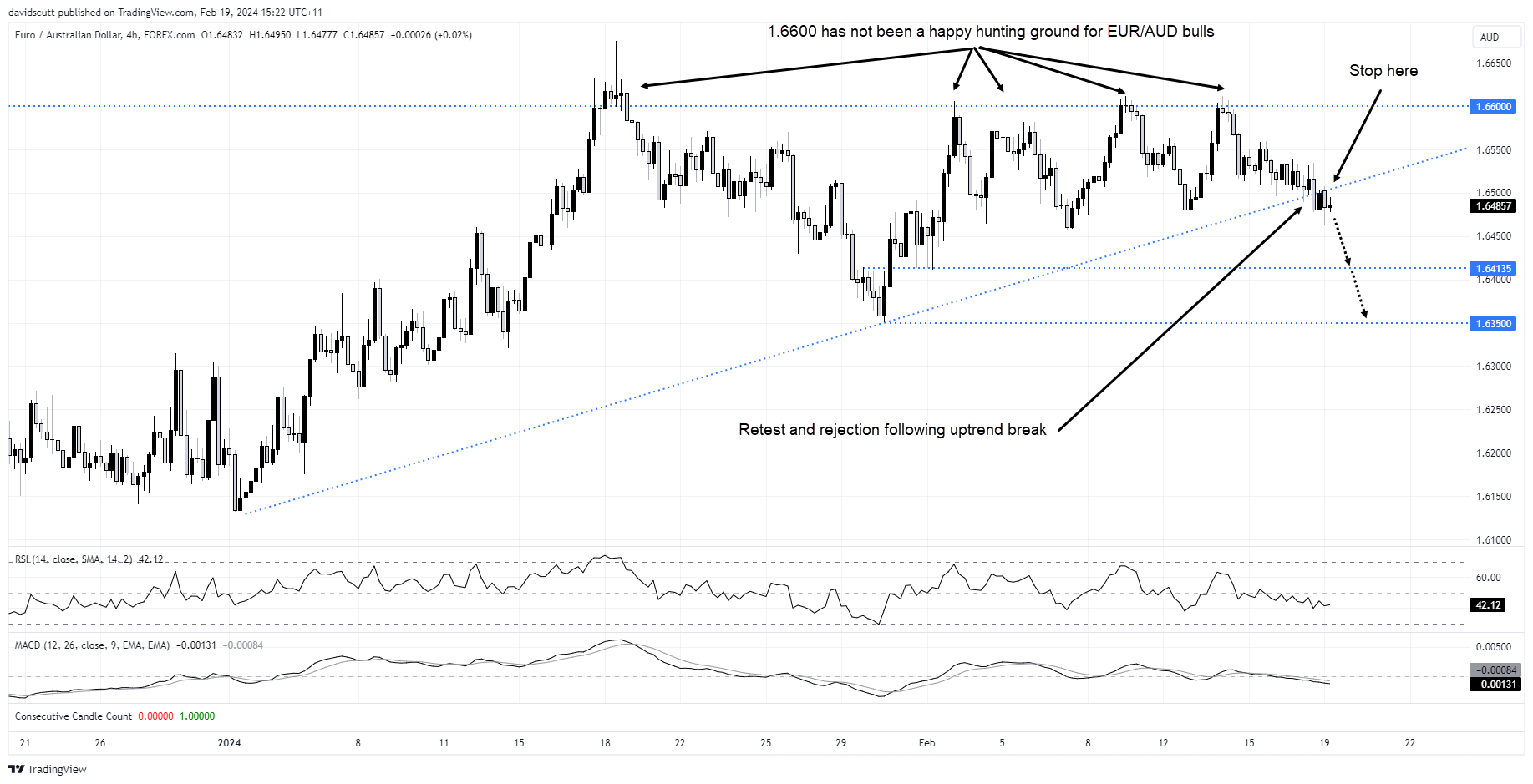

EUR/AUD rejected again above 1.6600

With the Aussie more susceptible to sudden shifts in risk appetite than other low beta currencies, it was no surprise to see EUR/AUD lift sharply on Tuesday last week as riskier asset types tumbled in response to the hot US January CPI report, seeing the pair briefly trade above 1.6600. However, for the fourth time in February, the probe above was unable to be sustained, seeing EUR/AUD not only move back below the figure but also take out the uptrend it’s been stuck in since the start of the year.

You can see on the four hourly chart below that having broken the trend on Friday, there was a back-test and subsequent rejection, signalling it is a level worth watching.

While there hasn’t been follow-through selling yet with the price attracting bids between 1.6460-80, continuing the pattern seen earlier this month, with momentum indicators such as RSI and MACD trending lower, there may be more downside than upside risks from the current level.

For those considering taking on a short EUR/AUD position, a stop above the trendline around 1.6510 provides a decent trade setup targeting a move to 1.6415 or even 1.6350 should downside momentum pickup.

Known event risk less than last week

With only second tier economic data on the calendar this week in Australia and Europe, and with other risk events such the minutes from the latest Fed and RBA policy minutes coming across as stale, the price action may not be driven by known risk events as was the case during parts of last week.

As mentioned in an earlier post, the US dollar index did not finish last week well, creating the impression the rally from the beginning of the year may be bearing exhaustion. While both AUD and EUR have been pressured by the stronger dollar, my sense is there’s more upside potential for the former than latter should the dollar start to weaken.

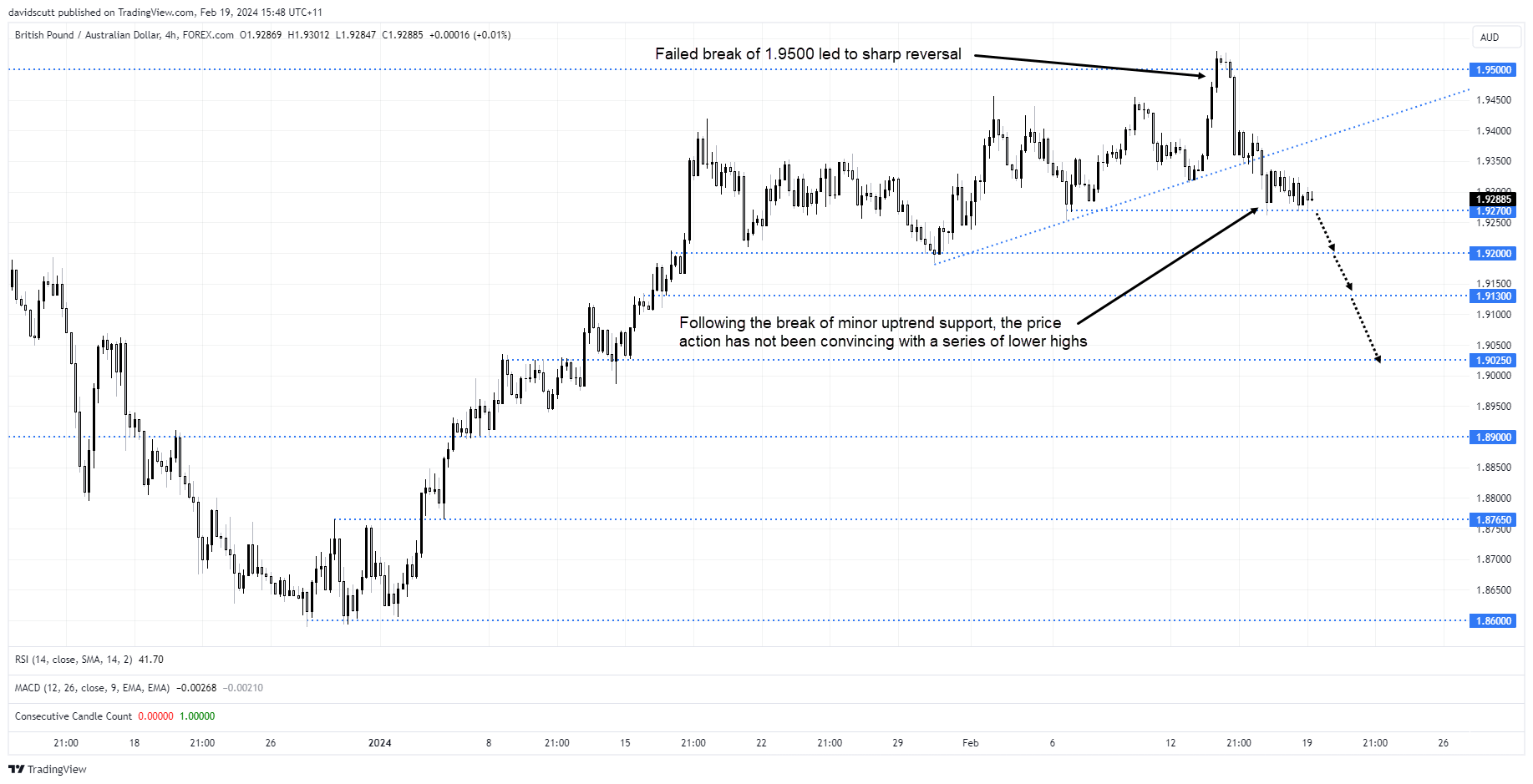

GBP/AUD looks heavy after latest upside failure

The GBP/AUD setup does not look dissimilar to EUR/AUD, although it’s arguably more advanced having broken a minor uptrend last week before pushing lower to test horizontal support at 1.9270. While it has been unable to break lower yet, the rejection above 1.9500, followed by the trend break and series of lower highs on the four-hourly, suggests there may be more downside to come near-term.

A clean break of 1.9270 opens the door to a push to 1.9200, where it attracted bids in late January. Below, support may be found at 1.9130, 1.9025 and 1.8900. I’d prefer to sell a break of 1.9270 with a stop-loss order above, but if you’re sensing downside and want to enter a trade now, the price struggled to break 1.9330 late last week.

-- Written by David Scutt

Follow David on Twitter @scutty