Strong US economic data has continued to send yields higher, on diminishing expectations of multiple Fed cuts. In additional, The Fed’s beige book (which summarises the US economy at a national and state level) saw little change since September. And that points to a robust economy with a strong labour market, and less-dovish Fed.

Fed fund futures are now pointing to a 92% chance of a 25bp cut in November – a far cry from the near-assured bets of back-to-back 50bp cuts just a few weeks ago.

23 million votes have already been cast for the US election, with several states such as North Carolina and Georgia already setting turnout records ahead of the big day on November 5. Yet with the election fast approaching, investors appear to be booking profits amid rising yields, USD and need to derisk as polls continue to point to a very close race.

The Bank of Canada slashed their cash rate by 50bp, marking their largest ‘non-pandemic’ cut in 15 years. Markets are still pricing in another 50bp cut in December.

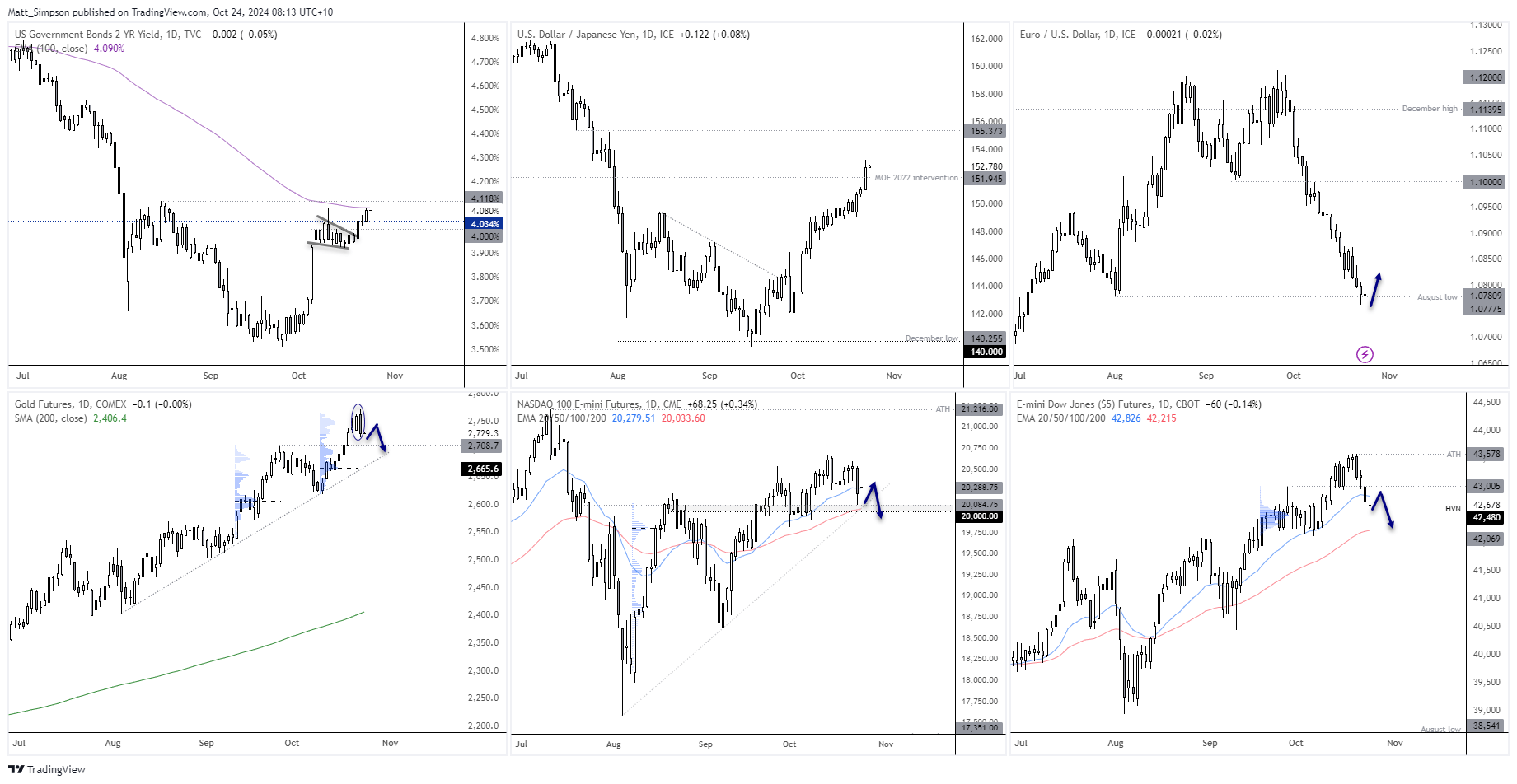

- The US 2-year yield closed at a 9-week high of 4.08 and extended its bull-flag breakout

- The 10-year yield closed above its 200-day SMA for a second day and printed a fresh 12-week high

- Wall Street was lower, led by the Nasdaq 100 which now trades around a day’s ATR above 20k

- Dow Jones extended its decline from its record high by as much as -2.5% by the day’s low and reached my downside target of 42,587

- The USD index saw an intraday break of the July 30 high

- USD/JPY closed above 152 for the first time since July 30

- EUR/USD saw an intraday break of the August low

- AUD/USD pierced the September low to mark its third 0.5% daily loss (or greater) in six

- Gold formed a bearish engulfing / outside day at its record high to hint at a potential retracement from frothy heights

Events in focus (AEDT):

- 10:50 – JP foreigner stock/bond purchases

- 11:30 – JP services PMI

- 18:30 – DE flash PMIs

- 19:00 – EU flash PMIs

- 19:30 – GPP flash PMIs

- 23:30 – US building permits, continuing jobless claims

- 00:00 – BOE Deputy governor Woods speaks, MPC member Mann speaks

- 00:45 – US flash PMIs

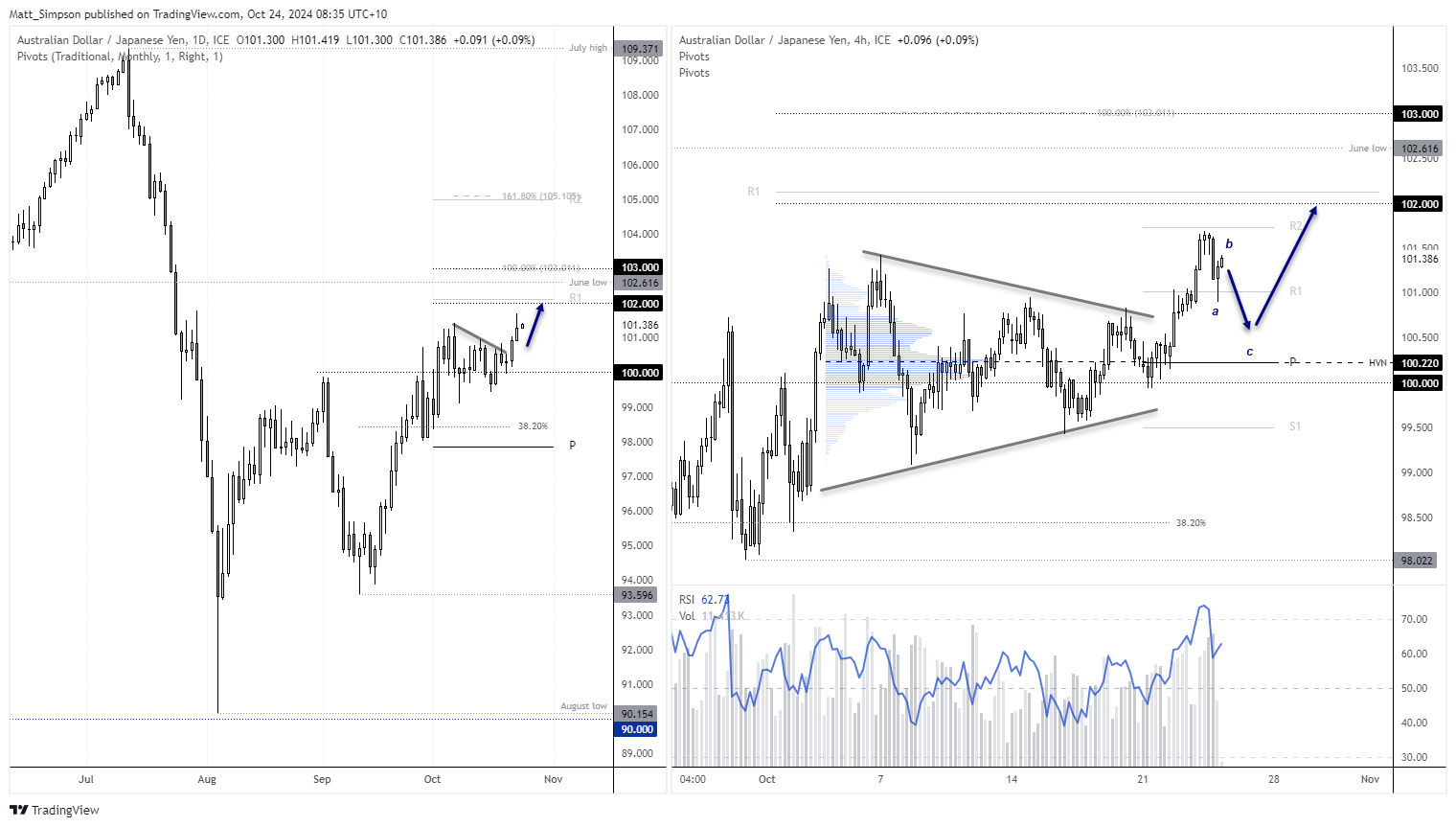

AUD/JPY technical analysis:

We’ve seen a decent breakout on AUD/JPY and the cross is now on track for the initial upside target around 102. However, the move lower on Wall Street has presented a bump in the road. Resistance was met at the weekly R2 pivot. And an ABC correction now appears to be underway. And that suggest another leg lower on the 4-hour chart before the breakout resumes.

But given the strength of the breakout form the ascending triangle, the bias is for the rally5 to resume towards 102 after the ABC completes.

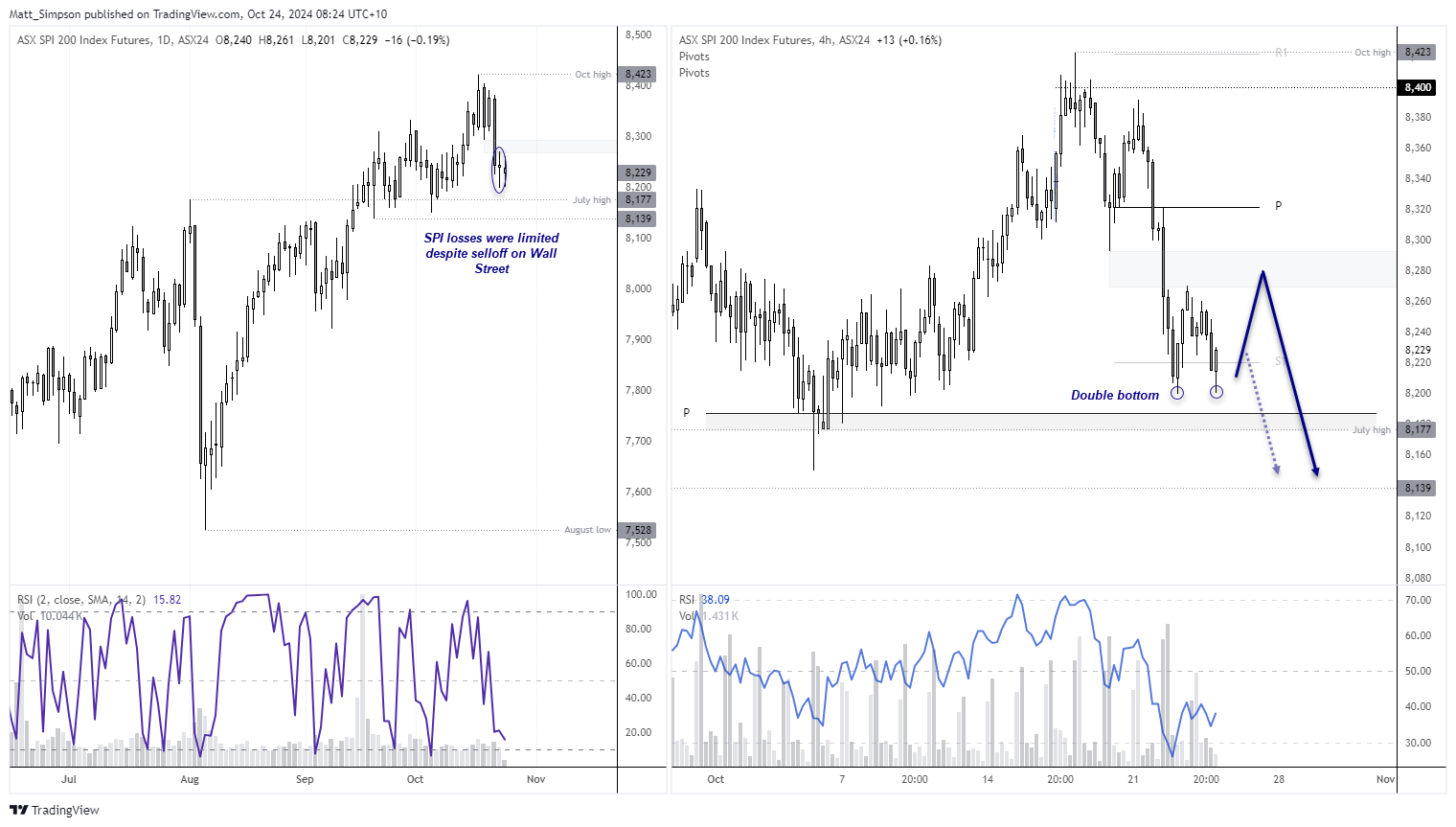

ASX 200 futures (SPI 200) technical analysis:

Typically, I’d expect the ASX 200 to suffer following a weak performance from Wall Street. Yet on this occasion, ASX 200 futures barely traded beneath Tuesday’s low and held above 8200. And as Nasdaq 100 and Dow Jones futures held above their own respective support levels, we may find that the ASX holds up today.

The daily chart shows that the ASX held above Tuesday’s doji, and the 4-hour is hinting at a double bottom around 8200 and the weekly S1 pivot. I’m looking for a simply bounce towards the 8270 – 8294 area before its next leg lower, towards the monthly pivot point (8188) and July high (8177). A break beneath which brings the 8139 low into focus.

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge