With Australia’s business and consumer sentiment rising, CPI ‘too high’ for the RBA and now Trump preparing his cabinet for inflationary policies and potential trade wars, the RBA could be closer to a hike than a cut. And another bumper employment report from Australia this week could strengthen those odds.

Australia’s business confidence rose to its highest level since January 2023 in October according to National Australia Bank (NAB). Its 7-point rise also marks its best month-over-month increase in 10 months, and first positive print since July. Business conditions remained flat at 7. In a separate report by Westpac, consumer confidence increased 5.3% to mark a second consecutive rise, while ‘outlooks over the next 12 months’ and ‘family finances’ also now net positive. While this is good news for those seeking a healthier economy, it is bad for those touting RBA rate cuts. Especially if coupled with higher wages and employment data this week.

Trump’s, trade and China in focus for Australian investors

We also need to factor in inflationary policies form the US and the potential for unfavourable trade negotiations. Treasurer Jim Chalmers has already warned that Australia won’t be immune from Trump’s ‘America first’ policies. Trump threatened to slap China with 60% tariffs during his campaign and, while such drastic actions seem likely to be aimed at Australia, it does not mean they’re off the hook.

It would also be wise to remember that Australia was caught in the middle of US-Sino tensions during Trump’s first term as President. Australia was seen to be cosying up too closely with the US which angered Beijing. Although what really soured the relationship between China and Australia was PM Scott Morrison helping spearhead an investigation on China over the outbreak of covid. While this is not expected on be repeated, it is a lesson on how political actions can come back to bite you.

For now, Trump is busy selecting cabinet officials which will help us shape expectations of what is to come. But trade relations with the US and China will becomes a dominant theme for Australian investors in 2025.

Australia’s wage price index, employment report in focus

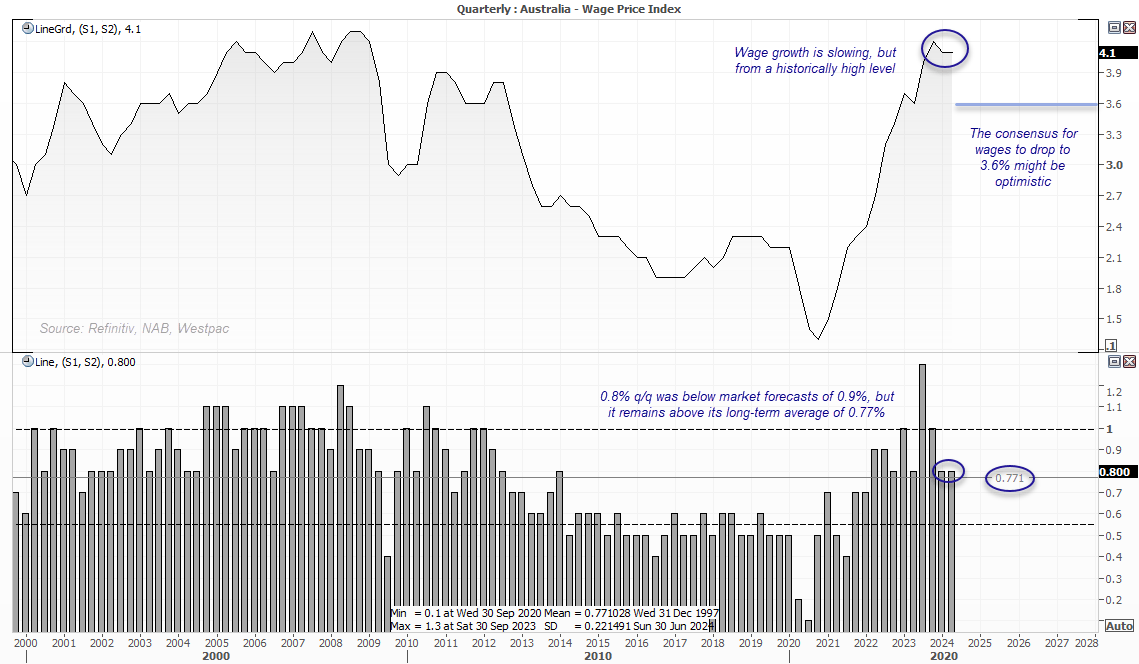

Wage growth is slowing, but it remained elevated at 4.1% in Q2 – even if it was its slowest pace in a year. Its 0.8% q/q was slightly below the 0.9% forecast, but also marginally above its 0.77% average. But like inflation, the RBA will want to see it fall at a faster pace before entertaining the though of rate cuts. Although a glimmer of hope from today’s NAB report is that labour input costs fell for another month, so perhaps we’ll see data soften here. The current estimate is for wages to soften to 3.6% y/y yet rise again to 0.9% on a quarterly basis.

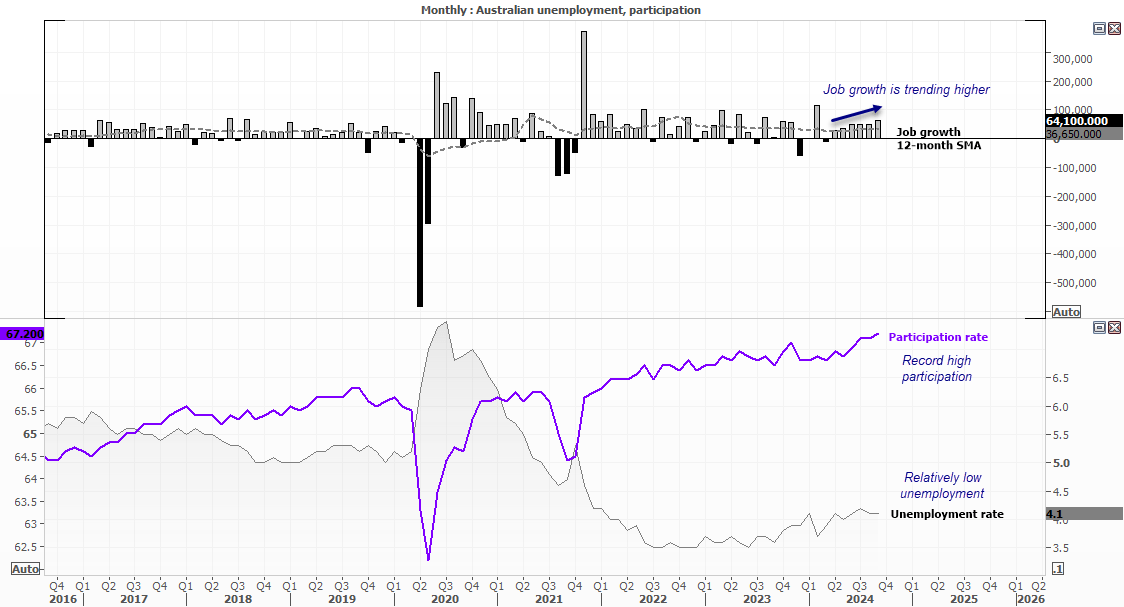

Yet employment in Australia remains ‘tight’, with a relatively low 4.1% unemployment rate, record high participation rate and rising employment-growth rate.

A glance at Australian’s employment figures

- 64.1k jobs were added in September, nearly twice its 12-month average of 36.7k

- 51.6k of them were full-time jobs, and FT has accounted for bulk of the headline growth the past five months

- Employment growth has increased for the past six months

- Participation rate has increased to a record 67.2

- Unemployment remained at 4.1%

Overall, these are strong figures. And this week’s business and consumer sentiment reports points towards another strong employment report. We know that the odds of a rate cut from the RBA are effectively dead, but with Trump now at the helm and the Australian economy remaining resilient, the RBA could be closer to a hike than a cut.

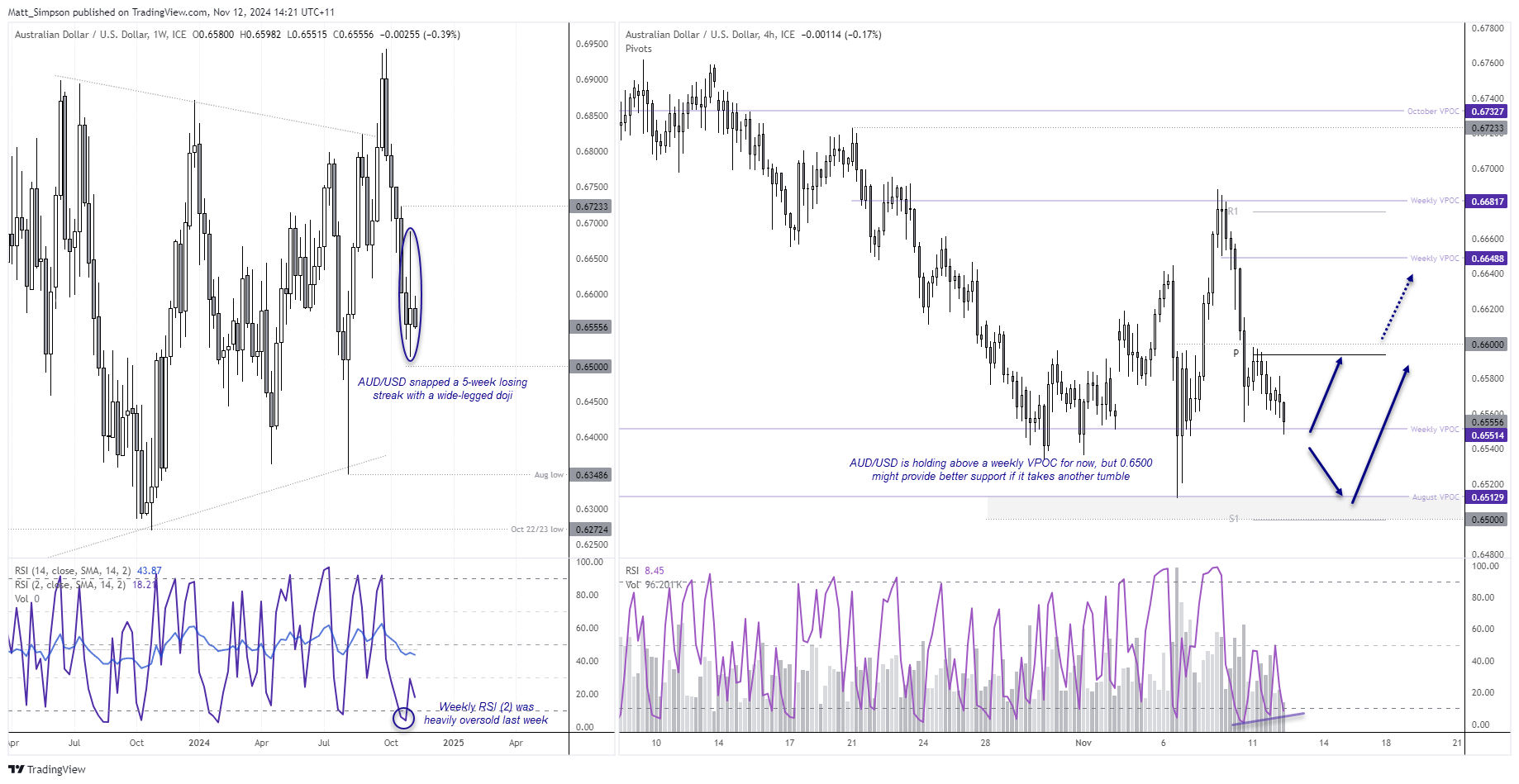

AUD/USD technical analysis:

While AUD/USD is on the ropes at the start of the week, it is also holding up to USD strength quite well. Prices have also found support around the weekly VPOC for now, but I suspect if prices continue lower that bulls might have better luck around 0.6500 – 0.6513 neat the weekly S1 pivot and another weekly VPOC.

Not only does that mark the election low, but also the low of the doji which snapped a 5-week losing streak. Upside targets include 0.6600 and the 0.6640 area near an upper weekly VPOC. But for the higher target to stand any chance, we likely need a strong AU employment report coupled with a stronger yuan).

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge