ASX 200 sector bias:

LONG:

- Financials

- Real estate

- Utilities

SHORT:

- Consumer discretionary

NEUTRAL:

- Consumer staples

- Energy (recently oversold, may seek fresh shorts later)

- Industrials (bullish overall but we’d like to see a deeper pullback first)

- Information technology (appears overextended to the upside)

- Materials

- Communication services

- Health Care

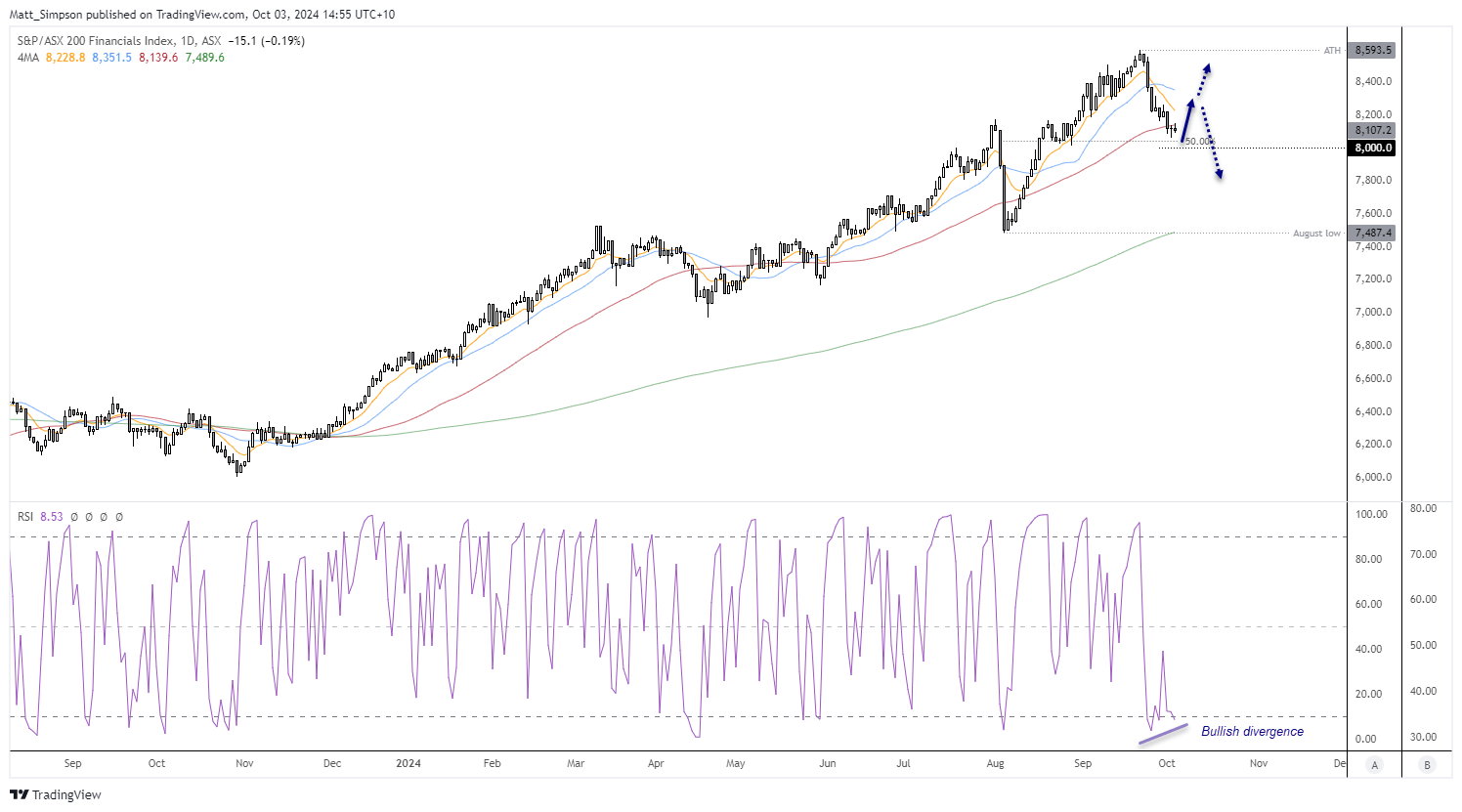

ASX 200 financials sector:

The ASX 200 financials sector reached a record high in mid September, although it has handed back close to 6% since (and in a relatively straight line). However, I suspect a swing low is nearing.

Commonwealth Bank (CBA) and National Australia Bank (NAB), the sector’s two largest stocks by market cap, are hinting at a swing low. And the sector itself is fast approaching the 50% retracement level of the August low to ATH, with the 8,000 handle just beneath.

Quite how much of a bounce we could be in for remains to be seen, but bears should at least tread carefully around these levels as the reward to risk seems unappealing to me.

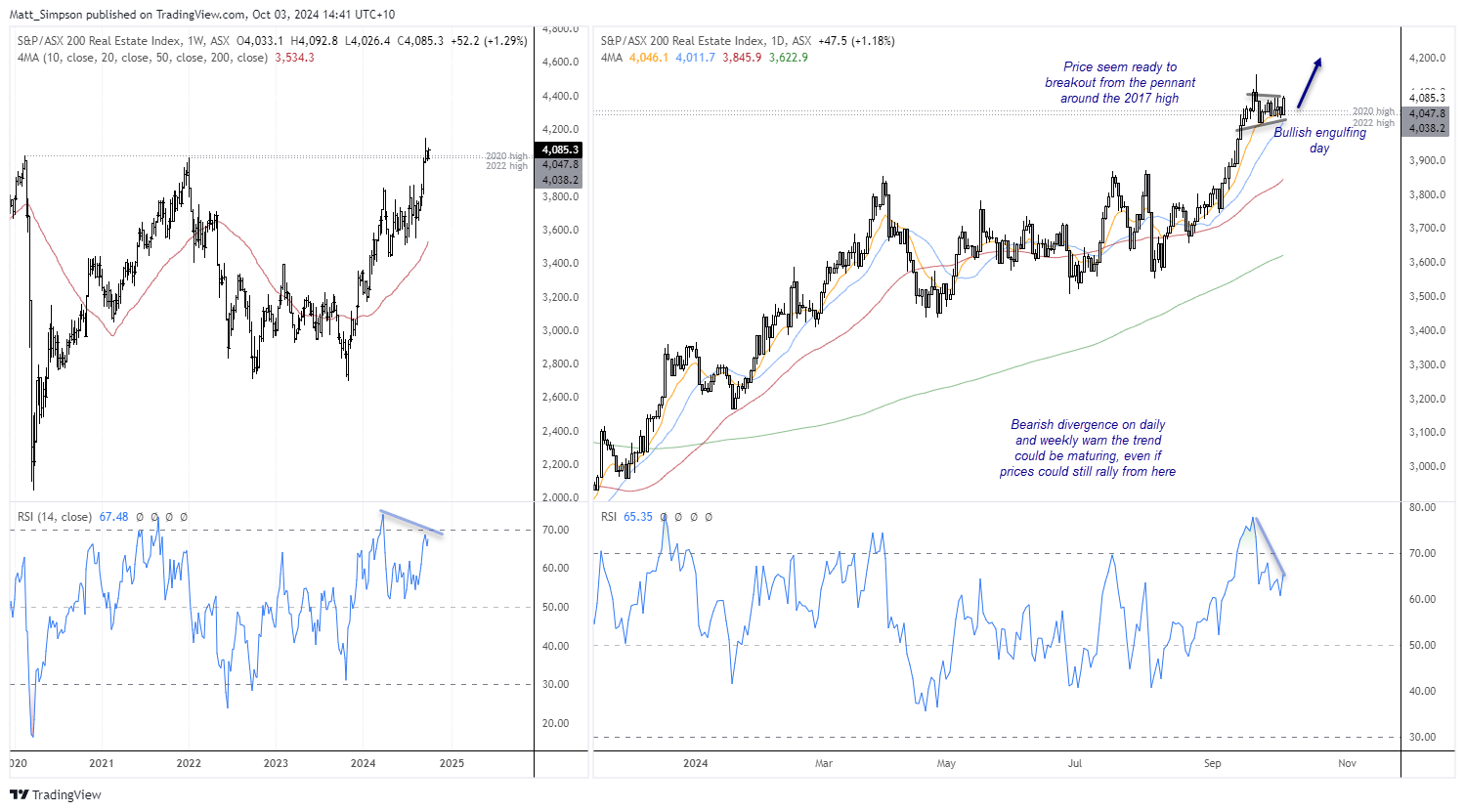

ASX 200 real estate sector:

The ASX real estate sector displays a decisively bullish trend structure on the daily chart. Prices recently hit a record high and since entered a small consolidation around the 2017 high, but momentum is now pointing higher to mark a potential breakout from a bullish pennant. The sector has also closed with a bullish engulfing day. I suspect another leg higher is now due.

However, keep in mind that the daily RSI reached overbought recently and a bearish divergence has since formed on the daily and weekly timeframe. Bulls therefore may want to keep tight stops and remain nimble for potential reversals lower.

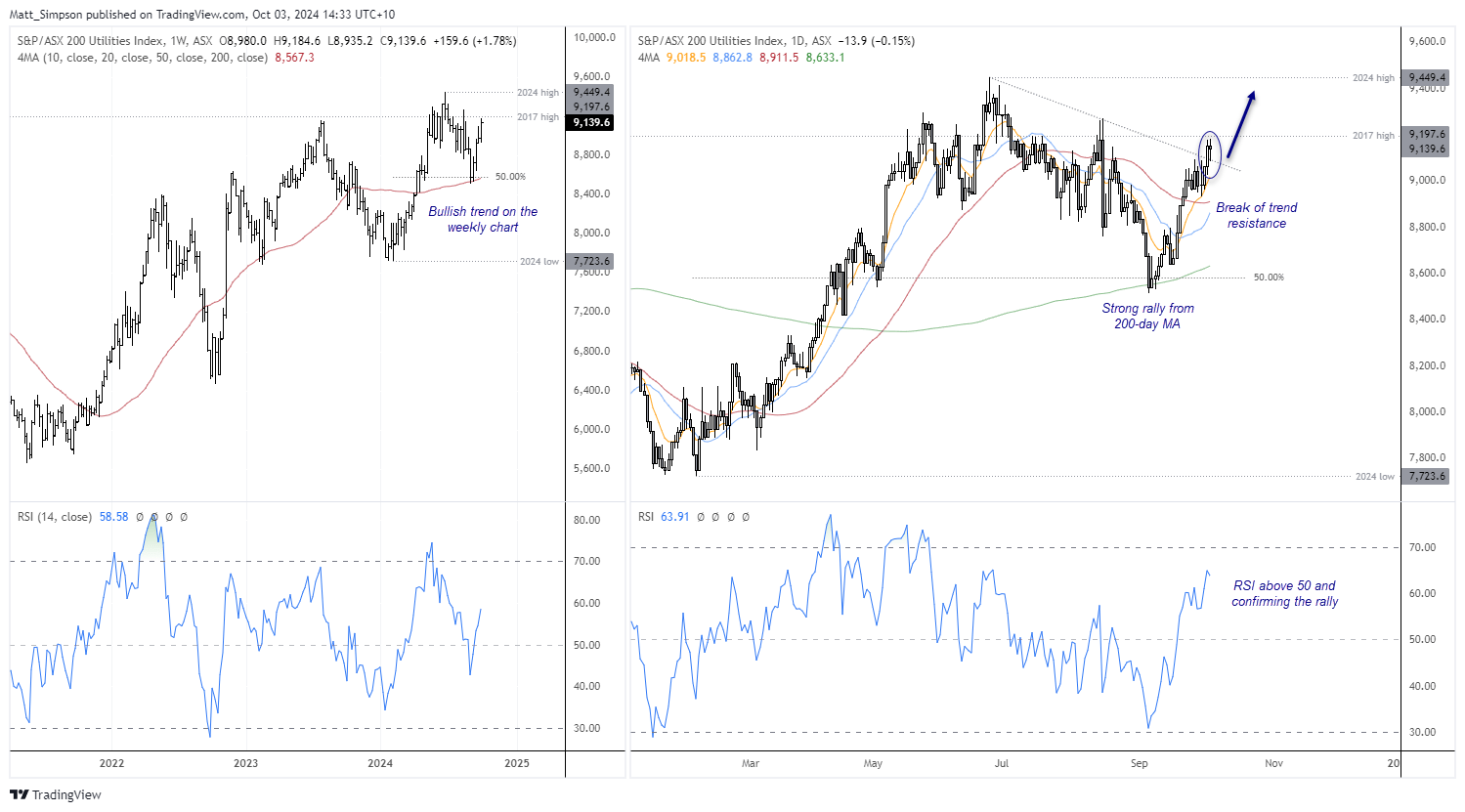

ASX 200 utilities sector:

The ASX 200 utilities sector finds itself at an interesting juncture, which on net favours a bullish breakout awaits. The weekly chart shows it is higher for a fourth week after a convincing bounce form the 50-week average and 50% retracement level.

The daily chart shows a strong rally from the YTD low to high and a 3-wave correction. The rally from the 200-day MA closed above trend resistance on Wednesday, although the sector is on track for a small doji – as it seems hesitant to break above the 2017 high for now.

Yet with the weekly and daily RSI (14) confirming bullish price action without being oversold or forming a bearish divergence, odds favour a break higher in my opinion.

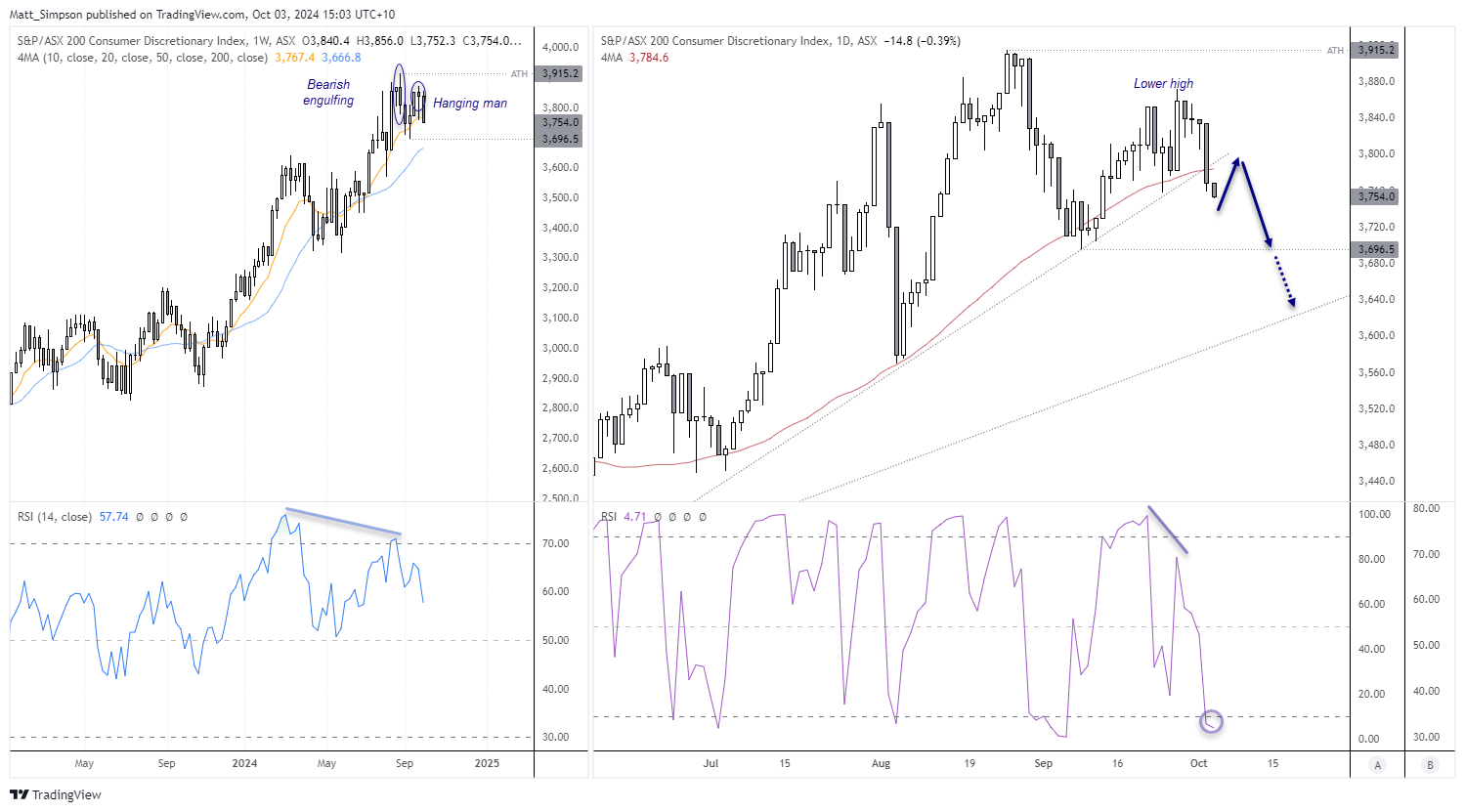

ASX 200 consumer discretionary sector:

The ASX 200 consumer discretionary sector appears to be in a spot of bother. Since the ATH set in August, a bearish engulfing and hanging man week have formed. The second candle of which is part of a lower high, and the monthly candles for August and September are also hanging man candles. A bearish divergence has also formed on the weekly chart.

The daily chart shows that prices have recently broken beneath trend support and the 50-day average, and momentum has continued lower today (albeit at a much slower pace). While the daily RSI (2) is oversold which suggest a small bounce could be due, the bias is for this market to head for the 3696.5 low – a break beneath which brings the bullish trendline from the October 2023 low into focus.

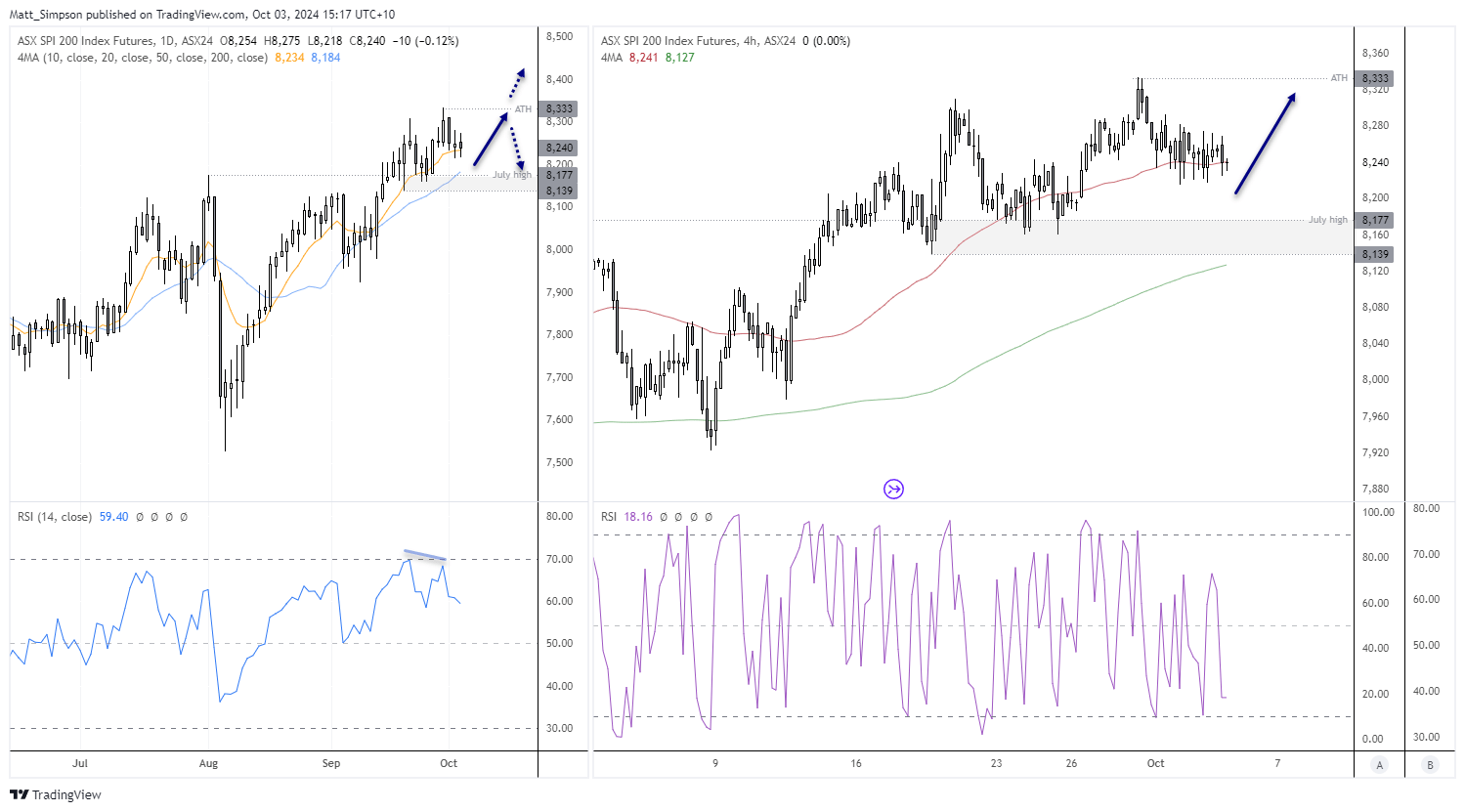

ASX 200 futures technical analysis:

As mentioned in yesterday’s report, the ASX and Dow Jones currently share a strong correlation and are two indices that have held up well to the recent bout of risk off. Should appetite for risk return, they could be looking at fresh record highs sooner than later.

Dips around support levels are preferred for fresh bullish setups given the bullish trend structure on the daily chart. The 8139 low to 8177 high (July high) may be a potential support zone for bulls to keep an eye on.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge