- Australian ASX 200 futures surged 1.5% on Friday, assisted by month-end window dressing

- Commodity prices were weak on Friday, including iron ore

- ASX 200 futures sit near the key 50-day moving average, providing a level to build trade ideas around

Obvious month-end window dressing in Australia and United States drove significant late session rallies on Friday, sending Australian ASX 200 futures surging 1.5% from the lows hit in Asia. But sitting near a key moving average that’s acted as a pivot point on multiple occasions in the past year, and with commodity prices down heavily on Friday including iron ore, whether the gains can stick is questionable.

S&P 500 futures surge dramatically late Friday

Here’s a 1-minute tick chart of US S&P 500 front-month futures showing the scale of the ramp that occurred in the last few minutes of physical trade on Friday, remembering it was likely driven by flows attempting to influence closing levels rather than fundamental factors.

Mirroring what ASX 200 futures dis hours earlier

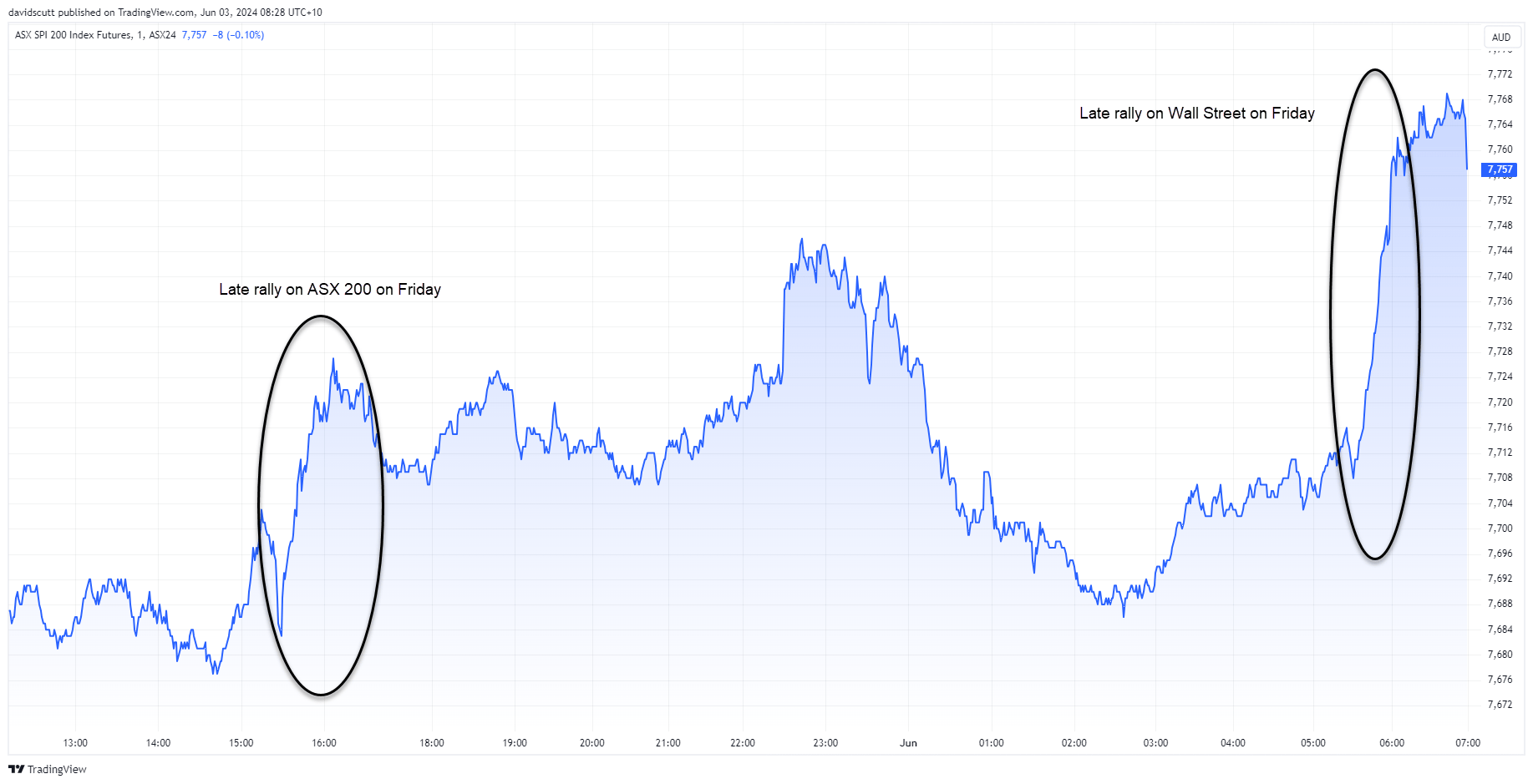

And this chart shows Australian front-month Share Price Index (SPI) futures on a one-minute tick timeframe, showing not only a similar ramp towards the end of physical trade on the ASX 200 on Friday but also the impact the late rally on Wall Street had on Australian futures into the weekend.

The question I’m asking is whether these gains will stick? Having seen enough window dressing in my more than two decades in markets, it’s not unusual to see these flows reverse and reverse hard when the turn of the calendar comes and mark to market considerations are nowhere near as pressing. And one look at the big declines in commodity markets on Friday suggest the largest component by index weighting – materials – may struggle to push higher on Monday.

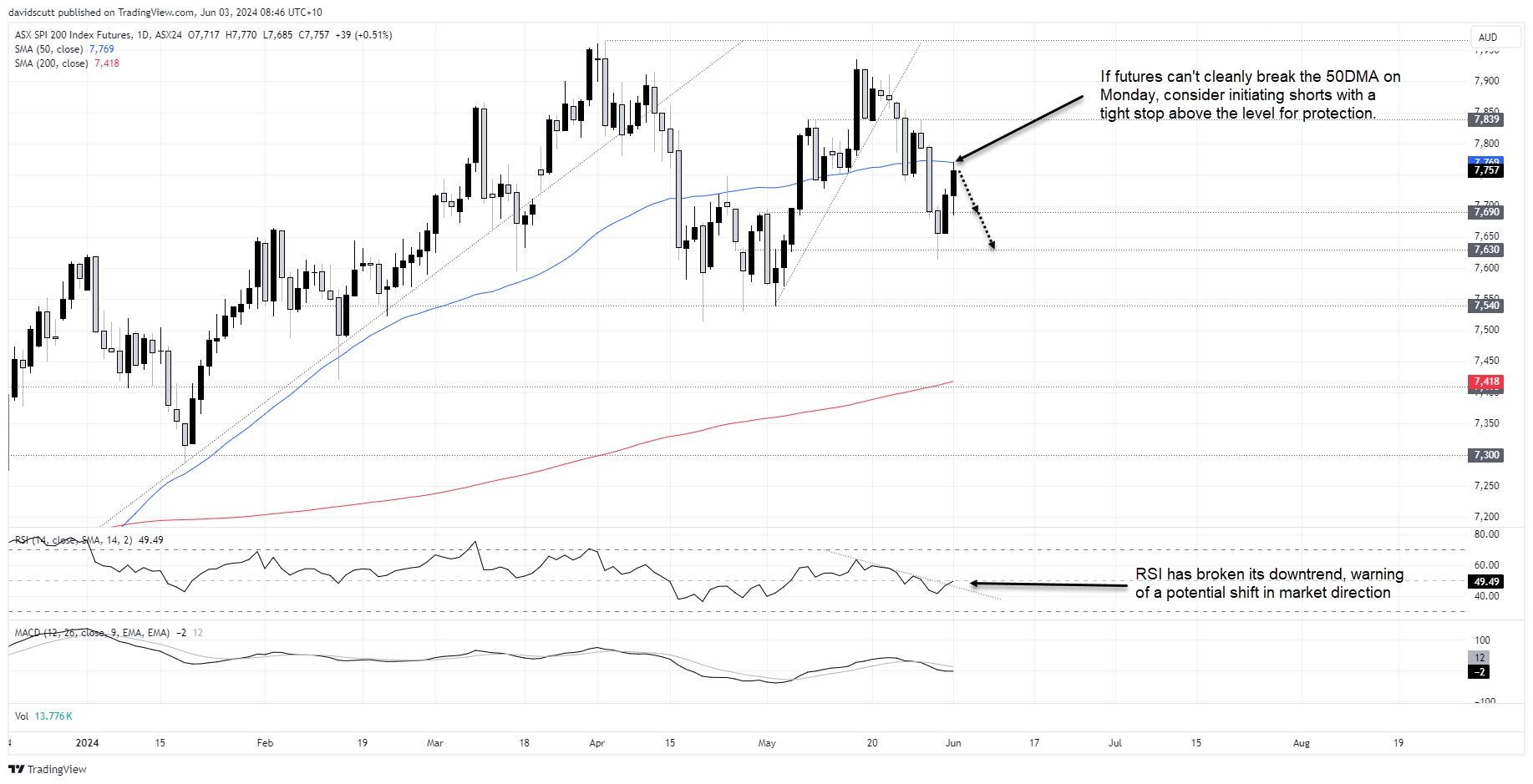

ASX 200 ramp halts at 50DMA

On the daily chart of SPI futures, you can see the rebound stopped dead at the 50-day simple moving average late in the overnight session on Friday, suggesting traders are still paying close attention to it as has been the case for much of the last year. And when this level eventually gives way, it tends to see futures extend the move from the direction in which it broke.

That makes Monday’s session important. If futures cannot reclaim the 50DMA, traders may want to consider initiating shorts with a tight stop above the level for protection. 7690 would be the initial trade target with 7630 the next after that.

Should futures manage to climb through the 50DMA, 7839 acted as both support and resistance during May, making that an obvious target.

-- Written by David Scutt

Follow David on Twitter @scutty