Asian Indices:

- Australia's ASX 200 index rose by 41.2 points (0.55%) and currently trades at 7,564.60

- Japan's Nikkei 225 index has risen by 182.76 points (0.68%) and currently trades at 26,982.21

- Hong Kong's Hang Seng index has fallen by -399.99 points (-1.86%) and currently trades at 21,118.09

- China's A50 Index has fallen by -39.78 points (-0.29%) and currently trades at 13,771.34

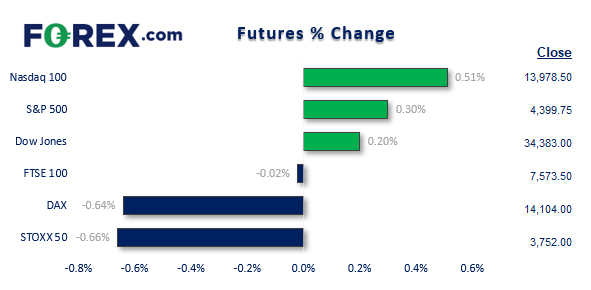

UK and Europe:

- UK's FTSE 100 futures are currently up 1.5 points (0.02%), the cash market is currently estimated to open at 7,617.88

- Euro STOXX 50 futures are currently down -26 points (-0.69%), the cash market is currently estimated to open at -26.00

- Germany's DAX futures are currently down -90 points (-0.63%), the cash market is currently estimated to open at 14,073.85

US Futures:

- DJI futures are currently up 85 points (0.25%)

- S&P 500 futures are currently up 76 points (0.55%)

- Nasdaq 100 futures are currently up 15 points (0.34%)

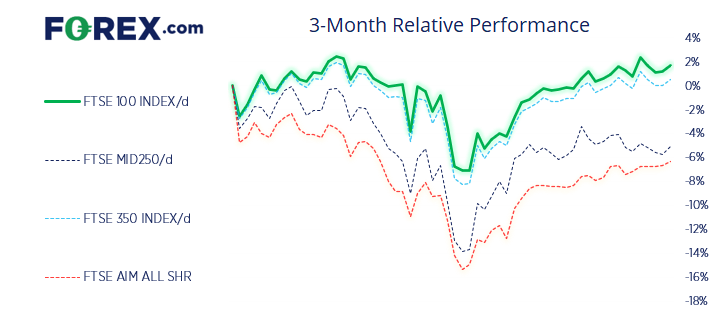

Momentum turns higher on the FTSE 100

The FTSE 100 managed to hold above the key support level of 7535 last week. Momentum turned higher on Thursday ahead of the 4-day weekend and the daily trading volume just above average and its highest in five days. Furthermore, a 3-day bullish reversal pattern formed called a Morning Star which suggest a swing low could be in place.

The four-hour chart shows prices broke out of compression and prices rallied from the 10-day eMA at Thursday’s open. Our bias today remains bullish above 7550, but we’d like to see 7600 hold as support and target the highs around 7670.

FTSE 100 trading guide

FTSE: Market Internals

FTSE 350: 4263.64 (0.47%) 18 April 2022

- 234 (66.67%) stocks advanced and 105 (29.91%) declined

- 9 stocks rose to a new 52-week high, 5 fell to new lows

- 35.04% of stocks closed above their 200-day average

- 53.56% of stocks closed above their 50-day average

- 10.26% of stocks closed above their 20-day average

Outperformers:

- + 7.75% - Wizz Air Holdings PLC (WIZZ.L)

- + 7.19% - SSP Group PLC (SSPG.L)

- + 5.92% - discoverIE Group plc (DSCV.L)

Underperformers:

- -8.73% - Darktrace PLC (DARK.L)

- -6.42% - Dechra Pharmaceuticals PLC (DPH.L)

- -6.14% - Vesuvius PLC (VSVS.L)

The yen continues to tumble

The US dollar extended its rally further following hawkish comments from James Bullard. He thinks rates should be at 3.5% by the end of year and, whilst stating 75-bps hikes are not the base case, also did not rule them out. The US dollar index taped 101 for the first time since March 2020.

The Japanese yen continued to weaken overnight despite verbal warnings from the Finance of Minister. Shunichi Suzuki said the economic damage caused by a weaker yen outpaces any benefits they get from it. The yen is the weakest major currency and USD/JPY reached 128 for the first time since in 20-years overnight. Commodity currencies were also stronger which saw AUD, CAD and NZD as the strongest majors overnight.

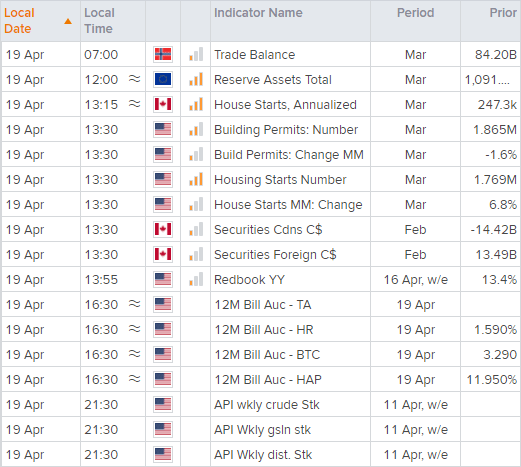

Up Next (Times in BST)

How to trade with FOREX.com

Follow these easy steps to start trading with FOREX.com today:

- Open a Forex.com account, or log in if you’re already a customer.

- Search for the pair you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.