Comex Copper Futures jumped to 2-years high, lifted by a rally of Yuan and the concerns about the risks of widening supply disruption.

In fact, the USD/CNH retreated from 7.190 in May and broke below the 2019 low at 6.670, recording a 2-year low level. China's GDP 3Q rose 4.9% on year (vs +5.5% expected), while September Industrial production grew 6.9% on year (vs +5.8% expected). Both data suggested that copper demand should be benefited from the recovery of China's economy. In addition, the strike at Chile's copper mine would reduce the supply of copper.

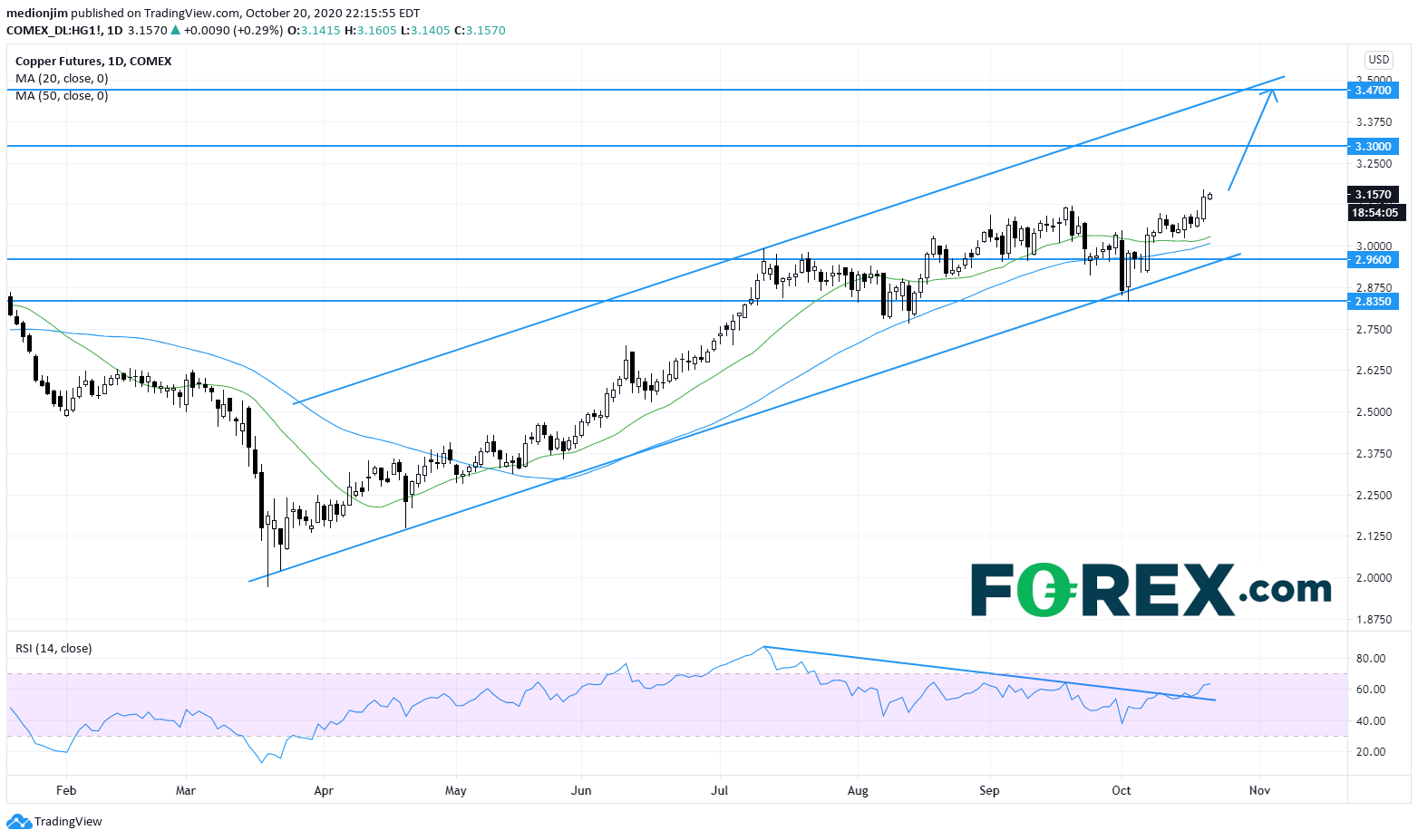

From a technical point of view, the Copper futures are trading within the rising channel on a daily chart, confirming a bullish outlook.

The relative strength index broke above the declining trend line drawn from July, suggesting that the rebuild of upward momentum.

Bullish readers could set the support level at $2.96, while the resistance levels would be located at $3.30 and $3.47.

Source: GAIN Capital, TradingView

In fact, the USD/CNH retreated from 7.190 in May and broke below the 2019 low at 6.670, recording a 2-year low level. China's GDP 3Q rose 4.9% on year (vs +5.5% expected), while September Industrial production grew 6.9% on year (vs +5.8% expected). Both data suggested that copper demand should be benefited from the recovery of China's economy. In addition, the strike at Chile's copper mine would reduce the supply of copper.

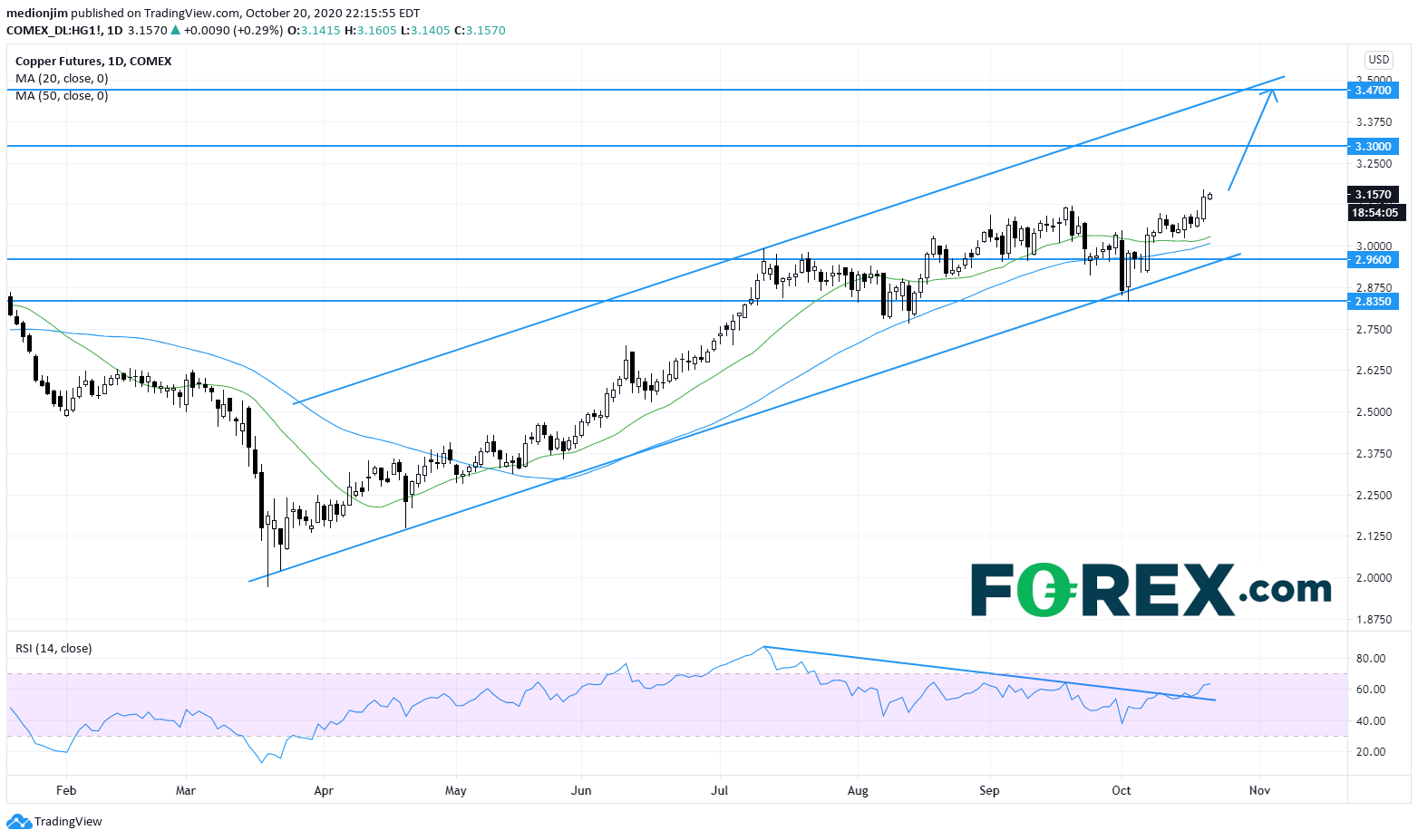

From a technical point of view, the Copper futures are trading within the rising channel on a daily chart, confirming a bullish outlook.

The relative strength index broke above the declining trend line drawn from July, suggesting that the rebuild of upward momentum.

Bullish readers could set the support level at $2.96, while the resistance levels would be located at $3.30 and $3.47.

Source: GAIN Capital, TradingView

Latest market news

Yesterday 07:55 PM

Yesterday 05:50 PM

Yesterday 05:30 PM

Yesterday 05:06 PM